(source:CJ newsroom)

After weeks of relying on late-night takeout, I began to feel the financial and physical toll. Eating out is getting expensive, and frankly, a little exhausting. With inflation on the rise and economic uncertainty lingering, price sensitivity is at an all-time high. So when I came across an article about the rise in frozen food sales in the U.S., I decided to do something I hadn’t done in months: make a Costco run. Between a desire for convenience and the need to stay on budget, frozen meals felt like the perfect middle ground.

And there, in the freezer aisle, something caught my eye: BIBIGO. Dumplings, bibimbap bowls, Korean-style chicken — all lined up like they belonged. What once felt like a niche choice now seemed completely normal. Not just for Korean Americans like me, but for everyone.

It made me wonder: How did Bibigo become such a big part of the American frozen food landscape? And who’s behind this rise of Korean food in everyday grocery stores?

Today, I want to take a closer look at Bibigo — not as a product recommendation, but as a real-world case study in how grocery, culture, and consumer behavior are intersecting in 2025.

📈The Numbers Behind the Boom

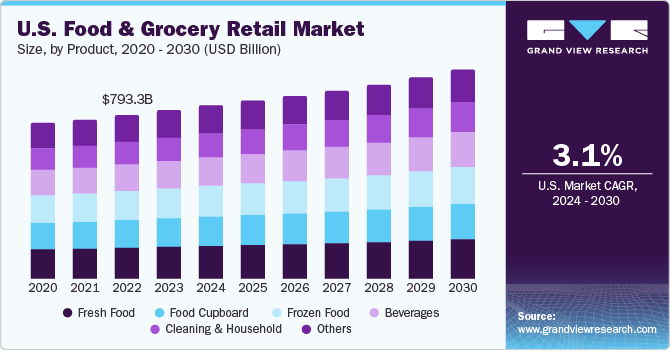

Despite ongoing economic uncertainty, the U.S. grocery market continues to show resilience and growth. According to the latest industry data, total grocery revenue is projected to reach $883.1 billion in 2025, reflecting a steady annual growth rate of 3.1% over recent years. This consistent upward trend highlights a market that’s adapting and expanding despite broader economic challenges.

(Source: Grand view research)

Grocery isn’t just about food anymore. We shop to reflect our values, habits, and even identity. Organic kale. Imported gochujang. Plant-based milk. Kimchi.

One colleague brings Bibigo dumplings for lunch. A family enjoys its bibimbap bowls during weekend dinners. Bibigo is no longer an occasional treat — it’s part of America’s weekly meal routine.

On TikTok, food creators are topping Bibigo bibimbap with soft-boiled eggs and kimchi. The brand has moved beyond frozen convenience — it’s now a base layer for creativity and culture.

There are now more than 305,000 grocery stores across the country—ranging from big-box retailers and regional chains to independent ethnic supermarkets and digital-first platforms. Each of them is playing a unique role in reshaping how Americans shop, eat, and connect with food.

(source: The Washington Post)

Where did Americans spend their grocery dollars in 2024?

| Category | Spending (in billions) |

|---|---|

| 🥩 Meat (Refrigerated/Frozen) | $113.9B (12.9%) |

| 🥐 Baked & Prepared Foods | $106.8B (12.1%) |

| 🥦 Fruits & Vegetables | $106.0B (12.0%) |

| 🥛 Dairy & Eggs | $68.0B (7.7%) |

| ❄️ Frozen Foods | $66.2B (7.5%) |

| 🥤 Beverages | $57.4B (6.5%) |

| 🛒 Other Items | $223.4B (25.3%) |

(Source: IBISWorld)

These numbers tell us how much we’re spending. They also reveal something deeper. We’re shopping not just for food, but for identity, values, and convenience.

Our grocery purchases now reflect who we are. We choose organic produce. We stock up on global ingredients like kimchi or curry paste. They show how we live and what we value—whether it’s sustainability, health, culture, or price.

Big Players Are Shaping the Grocery Experience

(source: Each homepage’s picture)

To understand the transformation of the U.S. grocery industry, we need to look closely at the companies leading the charge.

Let’s break down major players that are redefining what grocery means in 2025

Amazon Fresh: Driving digital-first shopping with AI, smart carts, and same-day delivery

Trader Joe’s: Staying offline but building brand loyalty through quirky in-store experiences

Aldi: Winning price-conscious shoppers with stripped-down selection and unbeatable efficiency

H Mart: No longer just for Korean Americans — now a hub for global food lovers everywhere

But one brand is standing out lately — not necessarily because it’s flashy, but because it quietly represents a larger shift in the way we shop and eat.

Let’s talk about BIBIGO.

Bibigo: From Korean Dumplings to American Freezers

When you walk into Costco or on the frozen aisle at Target, there’s a good chance you’ll spot Bibigo.

What started as a premium Korean dumpling brand has now grown into one of the most recognizable

K-food labels in the U.S. offering everything from microwavable bibimbap bowls to crispy chicken to gochujang sauces in squeeze bottles.

Bibigo is the flagship global food brand under Korea’s CJ CheilJedang, operating as CJ Foods in the U.S. It launched in Korean-American markets in 2015 and now occupies freezer shelves in Costco, Walmart, Amazon Fresh, and Target.

🔸 2024 Global Brand Revenue: ~$1.5B

🔸 Product Line: Dumplings, rice bowls, Korean-style chicken, kimchi, sauces, gochujang in squeeze tubes

Bibigo took Korean comfort food and repackaged it into modern formats:

- Bibimbap bowls that microwave in 5 minutes

- Gochujang in squeezable bottles

- Kimchi in single-serve packs

CJ Foods didn’t just translate Korean food — it redesigned it for U.S. convenience culture..

Why BIBIGO Won And Who It’s Up Against

Bibigo succeeded not only because of product excellence, but because it aligned perfectly with two megatrends:

- The Rise of Online Grocery — $10B+ spent in Jan 2024 alone, up 16.5% YoY

- The Mainstreaming of Ethnic Foods — Global ethnic food market projected to grow from $86.9B (2024) to $153.2B (2032)

📍 Bibigo sits at the intersection of global flavor and digital convenience — available at Costco, deliverable via Amazon, discoverable at Whole Foods.

Let’s compare:

- Trader Joe’s: Offers Korean-inspired items but lacks brand consistency or authenticity

- Annie Chun’s: Known for noodles and Asian fusion, but not positioned as a Korean staple

- Tai Pei: Low-cost, mass-market Asian meals, weaker in branding and quality perception

✅ Bibigo’s edge lies in balancing authenticity, accessibility, and aspirational value.

Beyond Sales BIBIGO as a Signal For What’s Next

Bibigo isn’t just a success story. It’s a living case study in how consumer identity is shaping food culture.

We now buy based on:

- Time savings

- Cultural identity

- Convenience and quality

CJ Foods understood this. It didn’t try to ‘dumb down’ Korean food — it made it functional, modular, and aspirational.

Bibigo became a routine, not a novelty. A cultural bridge, not a niche indulgence.

BIBIGO’S Brand Position At A Glance

| Strengths | Weaknesses |

|---|---|

| Widely available in major retailers | Still unknown in some rural areas |

| Large product variety | Pricey compared to other frozen brands |

| Cultural relevance growing | Not strong in fresh food categories |

| Opportunities | Threats |

|---|---|

| Growth in wellness and fermented foods | Competition from Asian-style brands |

| D2C, school lunches, meal kits | K-food saturation, loss of novelty |

Why Bibigo Thrives: Riding the Wave of Two Major Trends

Bibigo’s growth didn’t just come from great product development or savvy marketing.

It also arrived at exactly the right time — when two major shifts were transforming how Americans shop for food:

- The rise of online grocery shopping

- The mainstreaming of ethnic food culture

In January 2024 alone, Americans spent over $10 billion on online groceries — a 16.5% year-over-year increase.

Convenience, speed, and digital-first experiences are no longer perks — they’re expected.

At the same time, ethnic grocery items are no longer confined to specialty aisles or immigrant communities.

More and more consumers are reaching for Korean, Mexican, Indian, and Thai products — not just out of curiosity, but because they’re flavorful, functional, and often surprisingly affordable.

The global ethnic food market is projected to grow from $86.9B in 2024 to $153.2B by 2032.

Bibigo sits right at the intersection of these two megatrends.

It’s Korean, global, digital-ready — and designed for the way we eat now.

Whether through bulk packs at Costco, Prime delivery via Amazon, or casual discovery at Whole Foods,

Bibigo has made Korean food both accessible and aspirational — one frozen dumpling at a time.

Bibigo Is More Than a Brand

In today’s economy, we’re constantly navigating decisions what to buy, what to eat, what fits our time and our budget.

And in the midst of rising costs, time pressures, and shifting values,

we’re also forming new shopping habits — habits that reflect who we are and what matters to us.

Bibigo wasn’t discussed at length in this piece because it’s flawless or flashy.

It was chosen because it serves as one of the clearest, most accessible examples

of how the American grocery market is evolving right now.

Bibigo’s strategy and growth offer real insight — not just for food brands,

but for anyone trying to understand how culture, convenience, and identity intersect.

We no longer eat just to survive.

We eat to express who we are.

In that context, Bibigo isn’t just a brand selling frozen dumplings.

It’s a living data point a reflection of how modern consumers eat, live, and define themselves through everyday choices.

Curious what other grocery brands are winning the culture game?

Subscribe to the blog — we’re unpacking food, strategy, and the future of shopping

source: Bibigo hompage, Hmart, Alredi,patel brothers, rethink grocery homepage, IBISWorld,The Washington Post,grandveiwresearch,CJ newsroom

Leave a comment