What Happened to Affordable Stores?

(Pic from Trader DK)

When I first moved to the U.S., I encountered an unexpected gap. In Korea, affordable stores were not only everywhere—Daiso, street vendors, late-night marts—they were trusted. Low prices didn’t mean low quality. They meant thoughtful design, convenience, and function.

In the U.S., I searched for that same ecosystem. Walmart became my default because I didn’t know where else to go. Prices felt inconsistent, and the notion of a store where cheap and good coexisted seemed elusive.

Then, someone said: “Try dollar stores.”

I was skeptical. A dollar? What could you buy with that?

But curiosity won. I walked into a Dollar Store. The surprise was immediate. The selection was wide—groceries, cleaning supplies, seasonal items, even notebooks. Dollar General stood out. Not because it was flashy-but because it felt systematic. Not just cheap, but intentional.

In high school, it became a financial refuge. I learned to stretch allowance money, to gift creatively, to plan smarter. It wasn’t about spending less—it was about spending deliberately.

Years passed. Then, inflation brought Dollar General back into view.

A Resurgence Amid Economic Pressure

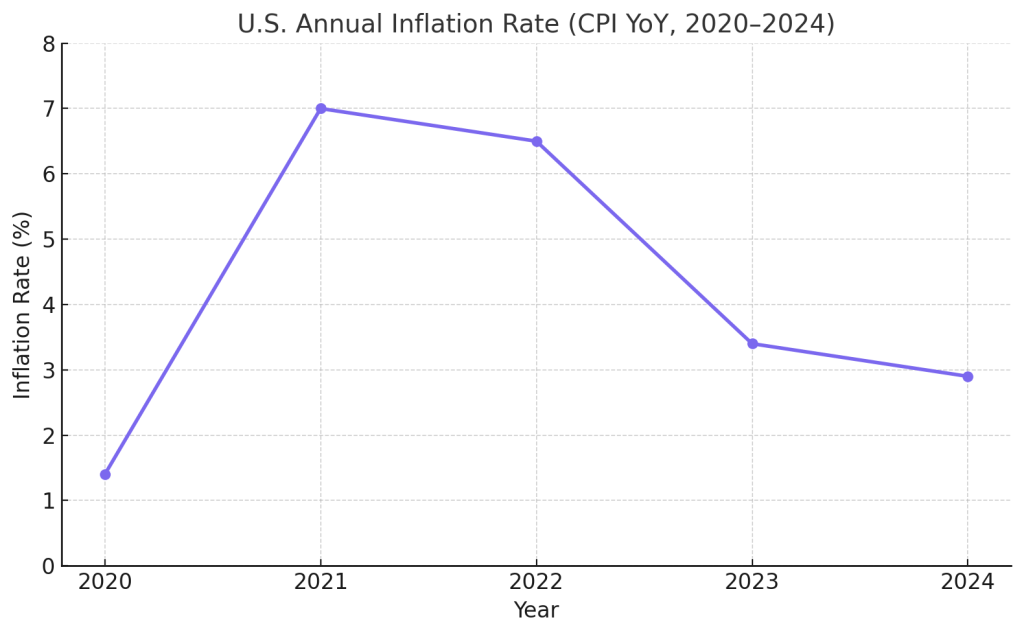

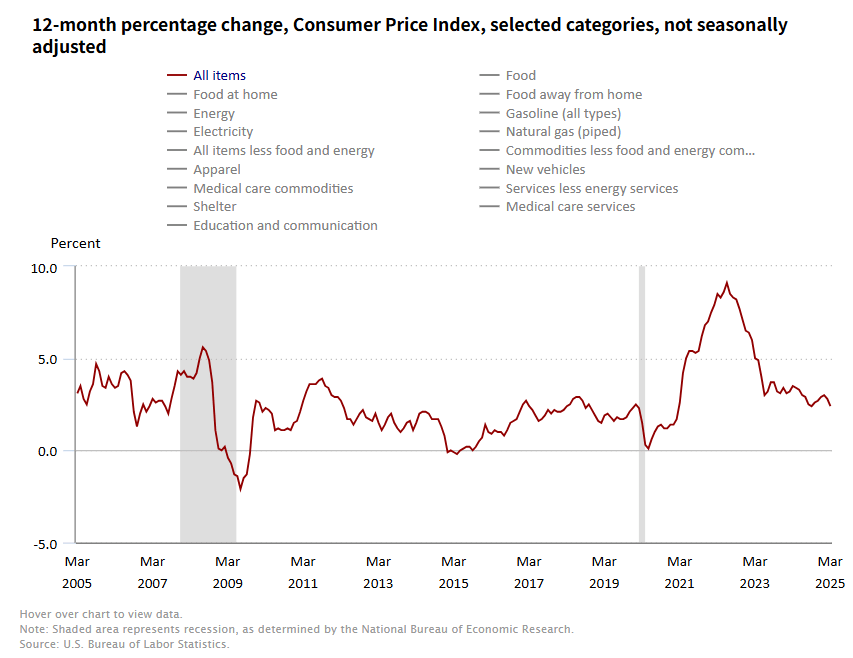

By the end of 2024, U.S. inflation had increased by 2.9% year-over-year, according to the U.S. Bureau of Labor Statistics. The rising cost of living wasn’t just affecting discretionary spending—it was reshaping daily essentials. From groceries to gas, from rent to childcare, everything felt heavier. The question wasn’t simply “Where can I save?” but “How can I survive without compromising basic quality of life?”

In response, consumers didn’t just seek lower prices. They pursued consistent affordability—solutions that were not only affordable, but also consistent, dependable, and rooted in practical market alignment. For many, that meant re-evaluating retail routines, abandoning premium brands, and rediscovering the kinds of stores they once overlooked.

That’s when Dollar General re-emerged in public consciousness. News articles highlighted its steady expansion into rural markets. Analysts flagged its stock as one to watch. Economists saw its rise as a signal of how American consumption was adapting to a more fragile economy.

Curious and somewhat nostalgic, I decided to return to my local store. What I found wasn’t the Dollar General I remembered. The store was cleaner, more efficiently laid out. The shelves felt more curated. Health-oriented products—whole grain snacks, low-sugar options, basic supplements—were prominently displayed. It wasn’t flashy- but it was strategic.

This wasn’t just survival. It was restructuring. Dollar General wasn’t clinging to the past—it was redefining its place in the present.

Dollar Stores in 2024: Central to American Consumption

Rising costs across key categories:

- Groceries: +2.5%

- Shelter: +4.6%

- Childcare: +3.6%

(Source: U.S. Bureau of Labor Statistics, 2024)

Result? As a result, dollar stores became essential. According to Mintel, 89% of U.S. adults now shop there. These stores are no longer stigmatized. They’re routine. With over 20,000 locations in the U.S. (Statista, 2024), they now outnumber Starbucks and McDonald’s combined.

Dollar General, in particular, is adapting the fastest.

Dollar General in Context

(Source: Shutterestock)

2024 Financials:

| Brand | 2024 Revenue | Net Income | Focus | Challenge |

|---|---|---|---|---|

| Five Below | $3.88B | $254M | Gen Z, trend-driven retail | Shrinking margins |

| Dollar Tree | $30.9B | -$3.03B | E-commerce, Family Dollar integration | Operational inefficiencies |

| Dollar General | $40.6B (+5%) | $1.125B (-32.3%) | Rural growth, small-format stores, wellness products | Inflation, logistics costs |

(Source: SEC EDGAR, 2024 Q4)

Dollar General’s revenue continues to climb. But its net income fell sharply—over 32%. This signals margin pressure from increased logistics and labor costs, and heavy capital expenditures in infrastructure and supply chain.

Is this a warning sign? Not necessarily.

Instead, it reflects a strategic shift—a company investing ahead of market demand to reposition itself long-term.

Dollar General Is Doing Differently

- Health-Conscious Inventory

- Its “Better For You” initiative now covers over 3,000 SKUs.

- Healthier snacks, basic nutrition, low-sugar alternatives.

- But: Limited access to fresh produce remains a gap.

- Small-Format Expansion

- 80% of new stores are <8,500 sq. ft.

- Easier to open in rural zones, lower operating costs.

- Trade-off: Reduced inventory breadth and local competition pushback.

- Digital Infrastructure & AI-Driven Logistics

- App development, store-level demand forecasting.

- Pilots for last-mile delivery in select ZIP codes.

- Challenge: Tech integration ROI remains unclear.

Dollar General’s strategy focuses on operational simplicity, rural market penetration, and digital modernization—all while managing rising operating expenses.

Community and Ethical Trade-Offs

Despite growth, the brand faces criticism:

- Food Deserts: Many stores lack fresh produce, exacerbating nutrition gaps in low-income areas.

- Labor Conditions: Reports cite low wages, understaffed stores, and safety violations.

- Retail Ecosystem Impact: Entry often weakens small local businesses.

These are not marginal concerns. They define how “affordable” intersects with equity and sustainability.

Beyond Price, Toward Purpose

(source: DG hompage)

To remain relevant and resilient, Dollar General must:

- Expand fresh food offerings, especially via “DG Fresh” distribution.

- Form partnerships with culturally diverse brands (e.g., Korean and Japanese goods).

- Increase price transparency and value tracking (e.g., unit cost comparisons).

- Improve labor conditions—wages, staffing, training.

- Engage communities through local hiring and feedback loops.

Affordability must not come at the expense of dignity or nutrition.

Value Is Evolving

My search for something like Daiso in America—a store where affordability meets utility—started as a personal quest. But over time, it revealed something larger: the shifting definition of value in a rapidly changing economic and cultural landscape.

In the past, value was often equated with spending less. Cheap was enough, as long as it got the job done. But today, that equation no longer holds. Value now includes context. It asks not just how much we pay, but why, for what, and at what cost to others.

In this new economy—marked by inflation, inequality, and shifting consumer priorities—value means:

- Spending intelligently: Making choices that are not just low-cost, but high-utility and fit-for-purpose.

- Spending ethically: Understanding the labor, supply chain, and environmental footprint behind what we buy.

- Spending adaptively: Adjusting behavior based on new constraints—be it economic, ecological, or cultural.

Within this framework, Dollar General may not be perfect, but it’s revealing an important truth: the brands that survive aren’t just the cheapest—they’re the most adaptable. The ones that recognize affordability is a system, not a sticker price.

Dollar General is not just reacting to inflation—it’s rethinking infrastructure, inventory, and identity. It’s not just offering discounts—it’s offering market alignment to people whose choices are limited not by desire, but by geography and income. That matters.

In a fractured, uncertain economy, companies like Dollar General don’t have all the answers. But their ability to evolve—to question their old assumptions and meet new needs—is worth watching.

Because ultimately, the future of value isn’t just about saving money. It’s about improving accessibility, dignity, and opportunity in the everyday lives of millions. And that’s a definition deserving attention.

Source: Forbes, Shutterestock, U.S. Bureau of Labor Statistics

Leave a comment