From Toys to Tools of Transformation

Lately, the news has been filled with stories of war and conflict. It’s heartbreaking to see that even in 2025, much of global attention still centers on tragedy. One thing that especially stood out to me in recent headlines is the use of drones as weapons.

I used to think of drones as toys. I flew one on the beach, marveled at drone light shows at festivals, and watched videos of Olympic ceremonies with synchronized drone displays. But today, those same devices have evolved into tools of surveillance, logistics and unfortunately, warfare.

Seeing something that once brought me joy being used in conflict felt deeply unsettling.

Just a few years ago, drones barely lasted 15 minutes on a single charge. Now they can fly for hours, autonomously navigate complex terrains, deliver packages, and inspect remote infrastructure. They’ve gone from novelties to industrial necessities.

That change made me wonder:

“How fast is the drone industry growing — and why?”

“What role is the U.S. playing in this evolution?”

This article explores the current state of the U.S. drone industry — its technological transformation, regulatory momentum, supply chain repositioning, and the strategic implications for business, security, and innovation.

Why 2025 Is the Strategic Entry Point for the Drone Industry

The U.S. drone market has reached a pivotal inflection point.

Key market indicators:

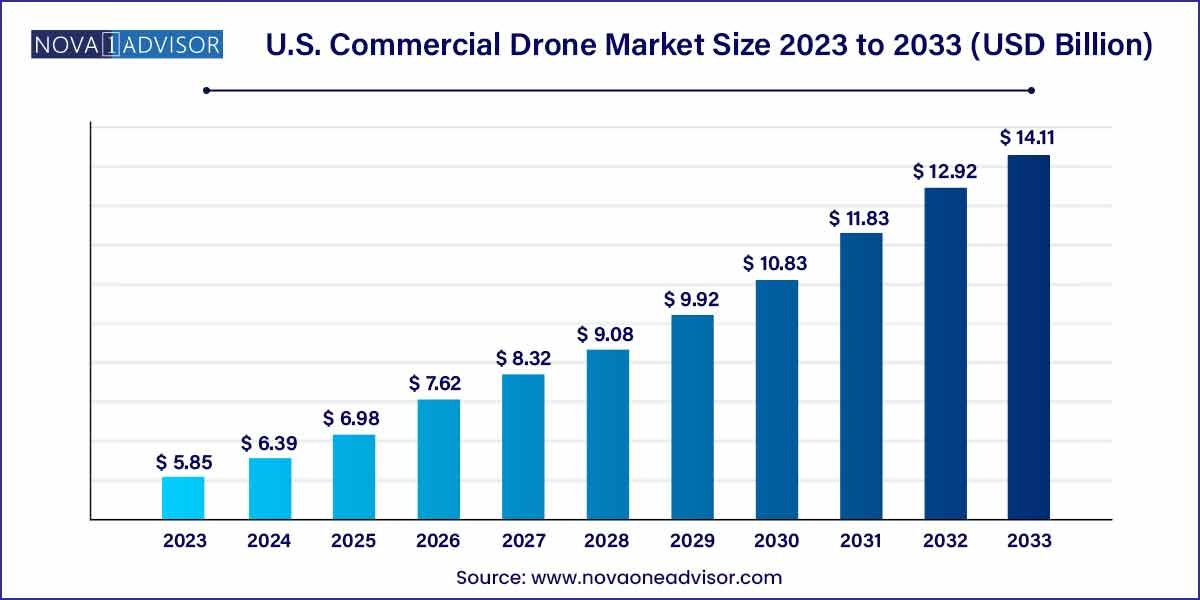

- 📊 Market Size: $6.39 billion in 2024 → projected $14.11 billion by 2033 (CAGR 9.2%, Nova One Advisor)

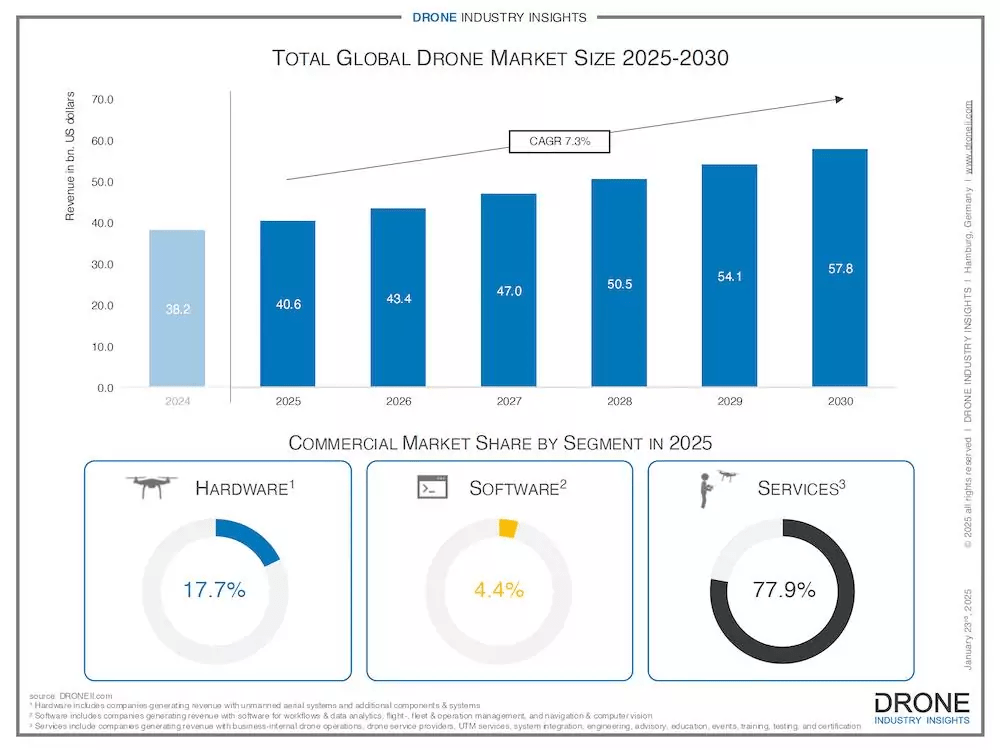

- 🌐 Global Drone Market: Estimated $127 billion by 2030 (PwC)

- 🚁 FAA-Registered Commercial Drones: 842,000 (2023) → 1.12 million (2028 forecast)

The combination of technology readiness, regulatory shifts, and cross-industry demand is creating a rare alignment.

Drones are no longer just “eyes in the sky” — they are becoming autonomous platforms for data, delivery, and decision-making.

Technological Transformation: Drones as Data-Producing Platforms

Hybrid Drones – Solving Range & Payload Limits

Innovations in propulsion systems — combining electric motors with gasoline or hydrogen power — have radically extended drone endurance and payload capacity.

| Model | Manufacturer | Flight Time | Payload | Feature |

|---|---|---|---|---|

| Skyfront Perimeter 8 | Skyfront | 13 hours | ~4.5 kg | Hybrid engine for endurance |

| Elroy Air Chaparral | Elroy Air | 480 km | 227 kg | Mid-range cargo drone |

| Firefly | Parallel Flight | 100 mins | 45 kg | High-heat rescue drone |

These capabilities enable drones to operate in logistics, energy, agriculture, and defense with minimal human involvement.

AI, SLAM, and 5G Integration

- SLAM (Simultaneous Localization and Mapping): Drones can build real-time 3D maps without GPS.

- AI Navigation: Enables autonomous obstacle avoidance, mission planning, and smart landings.

- 5G + Edge Computing: Allows real-time data streaming and command latency under 10ms.

Technology readiness note: These technologies are largely at TRL 7–9 — indicating pilot deployment or early commercialization. Companies like Skydio, Anduril, and Zipline are actively using them in defense, emergency response, and infrastructure inspection.

Industry Applications: Every Sector Is Going “Drone-First”

🚚Logistics

- Amazon Prime Air: FAA-approved drone delivery pilots targeting sub-30-minute delivery.

- UPS Flight Forward: Drones delivering blood and medical samples.

- Walmart-Zipline: Parachute-drop deliveries in multiple U.S. states.

🌾 Agriculture

- PrecisionHawk: NDVI imaging and predictive crop health modeling.

- John Deere: Integrated drone-tractor platforms for soil and irrigation analytics.

⚡ Energy & Infrastructure

- AES, Chevron, Duke Energy: Use drones for grid, turbine, and solar inspections.

- Lidar & thermal cameras: Identify millimeter-level anomalies in hard-to-reach assets.

🧯 Public Safety

- EPA & NPS: Wildfire detection, habitat monitoring

- Police & Fire Departments: Thermal rescue missions, live video reconnaissance

FAA Part 108: Unlocking the True Potential of Commercial Drones

From VLOS to BVLOS

Until now, FAA Part 107 allowed only Visual Line of Sight (VLOS) flights.

With the pending Part 108, Beyond Visual Line of Sight (BVLOS) operations will be allowed — expanding mission types and business models.

Requirements include:

- Sense-and-avoid technology

- Certified BVLOS pilots

- Resilient communication & emergency fallback protocols

Regulatory status: As of 2025, Part 108 is still in NPRM (Notice of Proposed Rulemaking) status. Widespread BVLOS deployment is pending final legal and certification frameworks. Most BVLOS flights still require waivers or pilot program authorization.

Still, Part 108 represents a monumental leap toward industrial-scale drone operations.

Spotlight on Skydio: The U.S. Leader in Autonomous Drone Systems

1. Company Overview

- Founded: 2014 in San Mateo, California

- Founder: Adam Bry (MIT Engineer)

- Mission: Develop fully autonomous drones to ensure U.S. leadership in drone tech

- Core Products:

- Skydio X2 / X10: Rugged AI drones for military & public safety

- Skydio Dock: Autonomous recharging base

- Skydio Cloud: Flight data and remote mission management platform

2. Market Positioning

- Core focus: AI autonomy and enterprise-grade security

- Primary clients: U.S. government, law enforcement, infrastructure firms

- Value proposition: “Made in USA” compliance, secure supply chain

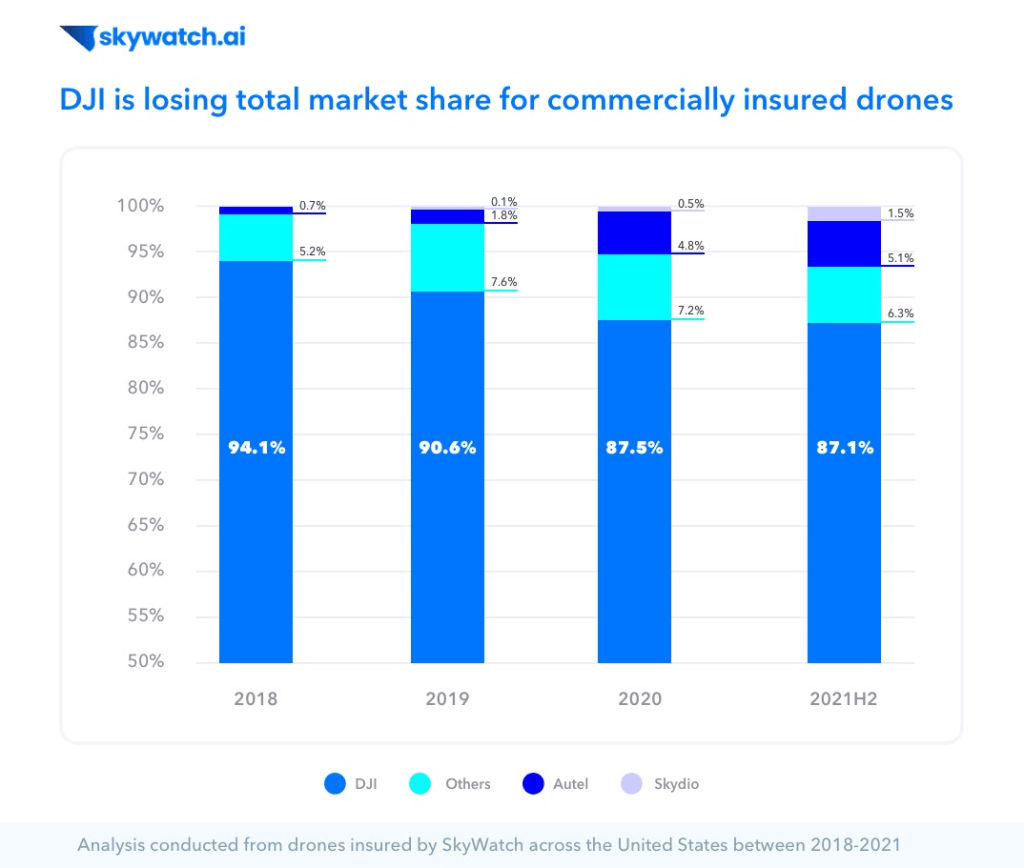

📌 Global context: Skydio leads U.S. autonomy, but faces international competition from:

- Elbit Systems (Israel)

- Auterion (Switzerland)

- DJI Enterprise (China)

- Swoop Aero (Australia)

Skydio’s growth has been boosted by Buy America-driven public demand. In the global private sector, it still faces challenges in brand recognition and cost competitiveness.

3. Growth & Financials

- Funding: $732 million raised

- 2023 Revenue: ~$100 million

- Valuation: ~$2.2 billion

- Revenue Growth: 30%+ CAGR (2020–2023)

4. SWOT Summary

| Category | Highlights |

|---|---|

| Strengths | AI autonomy, U.S. supply chain, SaaS revenue model, government trust |

| Weaknesses | Low consumer brand recognition, high cost for non-government clients |

| Opportunities | DJI displacement, Buy America mandates, export growth |

| Threats | Price wars, export regulations, supply risk, tech imitation |

Skydio is redefining itself not just as a drone builder, but as a drone-as-a-platform SaaS provider — integrating hardware, autonomy, and cloud analytics.

Conclusion: This Is the Strategic Window for Drone Innovation

In 2025, the U.S. drone industry is not just emerging — it’s scaling.

- Technologies like AI and hybrid propulsion have matured.

- Regulatory frameworks (Part 108) are aligning.

- Demand across logistics, energy, defense, and safety is surging.

📌 This is a rare moment of convergence between innovation, law, and business opportunity.

The question isn’t whether drones are ready. It’s whether you’re ready to use them.

Strategic Takeaways:

- Manufacturers: Focus on modular, BVLOS-compliant systems

- Software firms: Build AI, analytics, and automation on drone data

- Data companies: Leverage real-time visual and thermal data pipelines

- Enterprises: Rethink operations through aerial automation

2025 isn’t the beginning of drones. It’s the beginning of drones at scale.

Leave a comment