Lately, I’ve noticed that so many things seem to shift based on what former President Donald Trump says or does — especially when it comes to policy. The world is changing rapidly, and energy is one of the areas where we’re seeing these changes most vividly.

As someone who has always been interested in nuclear power, this caught my attention. As of 2024, Korea operates 24 nuclear reactors across 6 power plants, ranking 6th globally in nuclear power generation. Korea Hydro & Nuclear Power (KHNP) is the world’s second-largest nuclear operator, and nuclear accounts for about 30% of Korea’s total electricity production.

I’ve always believed that when used wisely, nuclear energy offers a safe and highly efficient way to produce electricity over long periods. Of course, when accidents do occur, the damage can be massive — just like Japan’s Fukushima disaster reminded us. It truly is an energy source with both light and shadow.

With that in mind, I decided to explore the current landscape of nuclear energy in the United States and what kind of opportunities might arise for Korea.

A Return to Nuclear Power in the U.S.

For years, the U.S. nuclear industry was stagnant. High construction costs, public skepticism, and complex regulatory hurdles had discouraged new projects. Many existing plants were shut down due to economic inefficiency.

But that’s no longer the case.

Recent U.S. administrations, both Republican and Democratic, have increasingly recognized nuclear power as a strategic component of clean energy and industrial competitiveness. His administration not only championed nuclear as a carbon-free, base-load energy source but also rolled out policies to relicense, restart, and modernize existing plants — and aggressively invest in Small Modular Reactors (SMRs).

Today, these efforts have materialized into concrete action — from regulatory reform and funding increases to renewed interest from private sector giants.

AI, Data Centers, and the Power Crisis: Why Nuclear Is Back

The resurgence of nuclear power in the U.S. isn’t solely driven by policy. It’s also being powered — quite literally — by data centers and artificial intelligence (AI).

Data Centers Are Energy Monsters

AI technologies like ChatGPT, autonomous driving, cloud services, and generative AI are driving exponential growth in 24/7 data center operations. These centers require an immense amount of stable, uninterrupted electricity. Renewable sources like wind and solar, while eco-friendly, are intermittent and climate-dependent.

In contrast, nuclear offers stable, continuous, carbon-free power, making it an ideal match for tech companies looking to future-proof their infrastructure.

U.S. Tech Giants Leading the Nuclear Push:

- Amazon acquired the Cumulus Data Center Campus in Pennsylvania from Talen Energy for $650 million, powered entirely by nuclear energy. It also invested $500 million in SMR developer X-energy.

- Google signed a power agreement with Kairos Power, an SMR startup, to receive 500MW by 2030.

- Meta (Facebook) issued an RFP to secure 1–4GW of long-term nuclear power supply by the 2030s.

This shift reflects a growing trend: nuclear power is no longer just national infrastructure—it’s an enterprise solution. And with this shift comes enormous global market potential for vendors, operators, and equipment suppliers — including Korean companies.

Turning Point — Who Is Kairos Power?

Kairos Power is a next-generation SMR (Small Modular Reactor) development company established in 2016 in Alameda, California. The company is developing a high-temperature reactor cooled by fluoride salt, known as KP-FHR. Compared to conventional light-water reactors, it aims to deliver safer and more cost-effective designs. Kairos Power gained significant attention after signing a 500MW power supply agreement with Google.

🔍 Below is a comprehensive company analysis report on Kairos Power.

Business Overview

- Founded / Headquarters: 2016 / Alameda, California, USA

- Founders and Key Executives:

Mike Laufer (CEO), Edward Blandford (CTO), Per Peterson (Professor at UC Berkeley) - Industry & Core Technology:

Energy sector / Small Modular Reactors (SMRs), specifically the fluoride-salt-cooled high-temperature reactor (KP-FHR) - Revenue Model:

Electricity production and sales, SMR technology licensing - Key Customer Segments:

Large technology companies (e.g., Google), government agencies, data center operators (B2B model)

Industry & Market Analysis

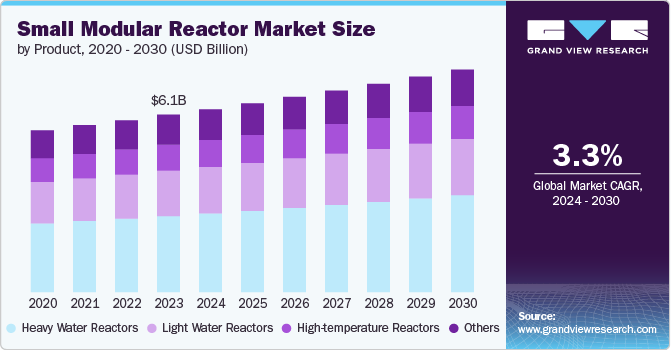

- SMR Market CAGR: Approx. 3.3%

From ~$6.1 billion in 2023 → ~$9.3 billion by 2032 - Growth Drivers:

- Energy decarbonization and transition

- Rising demand for stable power due to AI and data center growth

- Key Trends:

🔸 Strengthened carbon neutrality policies

🔸 Surge in high-output infrastructure from AI expansion

🔸 Regulatory easing and increased government investment in SMRs - Competitive Intensity:

The SMR market is highly competitive with players such as TerraPower, NuScale, and X-Energy.

→ Technology reliability and commercialization speed are key competitive factors.

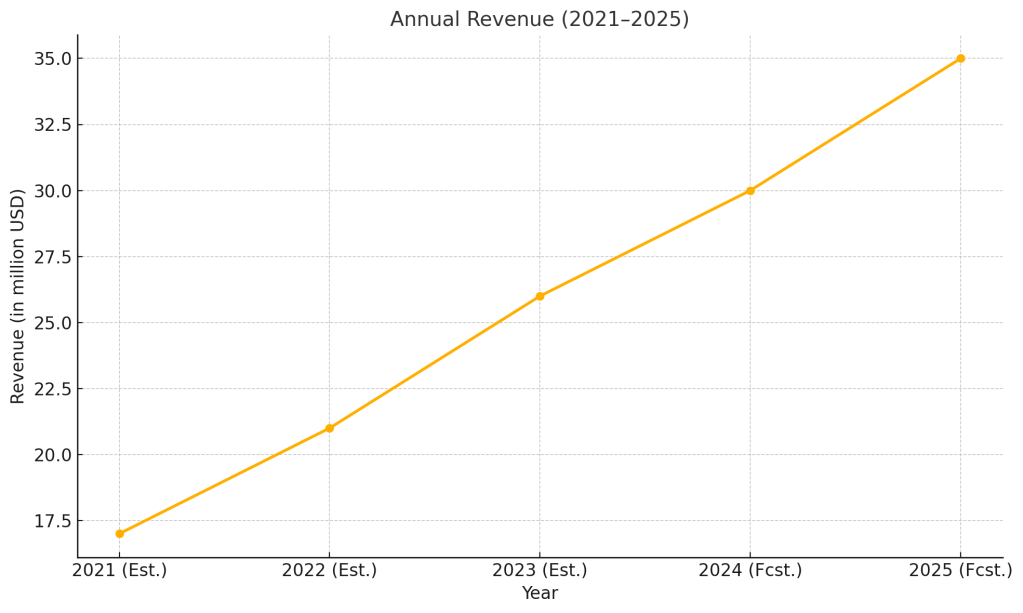

Financial Overview (5-Year Projection)

Kairos Power is a private startup, so its official financial statements are not publicly disclosed. However, based on external sources and industry estimates, the following projections are provided:

| Metric | 2021 (Estimated) | 2022 (Estimated) | 2023 (Estimated) | 2024 (Forecast) | 2025 (Forecast) |

|---|---|---|---|---|---|

| Annual Revenue | $17 million | $21 million | $26 million | $30 million | $35 million |

| Number of Employees | 253 | 298 | 340 | 375 | 408 |

| Major Funding | $303M grant from the U.S. DOE; 500MW power agreement with Google |

Key Financial Characteristics:

- High fixed costs driven by intensive R&D and engineering

- While Kairos Power is a private company and does not publicly disclose financials, revenue estimates are speculative and primarily based on indirect indicators such as government grants and project scale.

- ▪ Not yet commercialized; focus remains on long-term product development and demonstration

CEO Vision & Founding Motivation

- Founding Purpose:

“Improve the quality of life for humanity through sustainable energy.” - Kairos Power was founded to address the high cost and complexity of conventional nuclear power by developing simpler, safer, and more affordable technologies.

Mike Laufer’s Leadership Philosophy:

✔ Mission-driven development

✔ Iterative prototyping (inspired by SpaceX)

✔ Cost-based innovation targeting high efficiency

✔ Strong emphasis on public-private strategic partnerships (e.g., U.S. government + Google)

“We must solve climate change by making clean energy affordable, reliable, and scalable.”

— Mike Laufer

SWOT Analysis

| Category | Details |

|---|---|

| Strengths | ✔ Proprietary KP-FHR technology ✔ Strategic partnership with Google ✔ Robust U.S. Department of Energy (DOE) support |

| Weaknesses | ❌ Commercialization timeline remains uncertain ❌ Supply constraints on HALEU (High-Assay Low-Enriched Uranium) fuel |

| Opportunities | ✔ Increasing global demand for SMRs ✔ Expanding AI and data center energy requirements |

| Threats | ❌ Potential regulatory delays and public nuclear skepticism ❌ Strong competition from TerraPower, NuScale, and X-Energy |

Competitor Analysis

| Company | Core Technologies / Characteristics |

|---|---|

| TerraPower | Sodium-cooled fast reactor; backed by Bill Gates; emphasizes spent fuel recycling |

| NuScale | First SMR design approved by the U.S. NRC; executing multiple government projects |

| X-Energy | High-temperature gas-cooled reactor (HTGR); specializes in TRISO fuel technology |

👉 Kairos differentiates itself through in-house manufacturing and simplified design, focusing on faster construction and improved cost efficiency.

10-Year Outlook

| Year | Milestone |

|---|---|

| 2027 | Hermes demonstration reactor scheduled for activation |

| 2030 | KP-FHR commercial reactor launch; first power delivery to Google |

| 2035 | Full delivery of 500MW to Google anticipated |

If these milestones are achieved as planned, if the company meets its technical and regulatory milestones, Kairos Power could become a significant player in the emerging SMR sector. However, competition and commercialization risks remain substantial.

Kairos Power is a next-generation nuclear energy company rapidly gaining ground in the SMR market, driven by its mission to combat climate change through innovation and partnerships. With breakthrough technology and strong government and industry backing, the company is poised to become a transformative force in global energy.

The next decade — especially the success of its Hermes and Google projects — will determine whether Kairos secures a leadership position in the competitive SMR landscape. Based on its current trajectory, the company is well-positioned at the heart of this emerging market.

A Major Opening for Korean Companies

This new American nuclear wave opens massive opportunities for Korean firms with robust experience and advanced nuclear technology. Korea is uniquely positioned to serve as a strategic supplier and partner, not only because of its strong domestic capabilities, but also because several Korean companies already possess the engineering expertise, safety record, and global project experience comparable to the U.S. frontrunners.

- Proven Tech: APR1400, SMART reactors, and reactor extension technologies

- Top-tier Operator: Korea Hydro & Nuclear Power (KHNP), the world’s No. 2 operator

- Supply Chain Strength: Korea’s reactor component suppliers, maintenance firms, and engineering specialists form a world-class ecosystem

- Trusted Ally: As the U.S. avoids partnerships with China and Russia, Korea is emerging as a trusted and democratic partner

Many SMR companies, including Kairos, require outside expertise and hardware to bring their visions to life. This is where Korea’s design, component manufacturing, and field-service capabilities can play a crucial role.

Final Thoughts: At a Crossroads of Nuclear Innovation

The U.S. is ramping up its nuclear strategy — not only to power its grid but to fuel its AI, cloud, and defense future. Whether Trump or another leader is at the helm, the direction is clear: Nuclear is back.

This isn’t just a policy trend. It’s a global industrial transformation. And Korea — with its world-class technology, proven track record, and trusted reputation — is uniquely positioned to lead, supply, and partner in this next-generation energy future.

The AI era demands energy. And nuclear is ready to meet that demand.

South Korea, with its advanced reactor technology, strong regulatory reputation, and proven project execution, is well-positioned to become a core strategic partner in the global SMR value chain — not just as a hardware supplier but as a co-developer and system integrator.

Leave a comment