Have you ever heard of makgeolli? It’s a traditional Korean alcoholic beverage made from rice, and it offers a unique appeal distinct from soju. While soju is widely recognized abroad, makgeolli has been quietly making its way into the spotlight — especially among younger generations in Korea, where it's often rebranded under trendy names like "Makgeolli Cider" or "Malsul". This fermented rice wine, brewed with a fermentation starter called nuruk, has long held a place in Korean culture, but today it’s capturing hearts far beyond its homeland.

Interestingly, when makgeolli is distilled, it becomes the familiar Korean spirit known as soju. But unlike its distilled counterpart, makgeolli is low in alcohol, unfiltered, and packed with probiotics. These features are now aligning perfectly with global health and wellness trends. During my time in the U.S., I started noticing “Makgeolli”, “Korean Rice Wine”, or “Korean Wine” showing up in restaurants, markets, and even hip wine bars.

I was intrigued to see mango, yuzu, and blueberry flavored versions — a far cry from the plain, milky-white makgeolli I was used to in Korea. It was clear that makgeolli had evolved from a nostalgic drink into a versatile, global lifestyle product.

That realization sparked a question:

How exactly is makgeolli establishing a foothold in the American alcohol market? And what makes it so appealing to U.S. consumers?

To answer that, I looked into market trends, cultural positioning, and two standout brands that are making waves: Hana Makgeolli and Màkku.

From Tradition to Trend: The Globalization of Makgeolli

Once considered outdated in its home country, makgeolli has undergone a dramatic transformation. Now, it’s being embraced by young, urban consumers in the United States as a trendy fermented beverage — one that sits at the intersection of culture, health, and aesthetic experience.

The rise of makgeolli is no coincidence. It’s part of a broader wave of K-Culture, driven by the explosive global popularity of BTS, Parasite, Squid Game, and The Glory. Korean cuisine, fashion, and traditional crafts have all gained newfound appeal, and makgeolli is riding that cultural momentum.

A Bright Future for Makgeolli in the Global Market

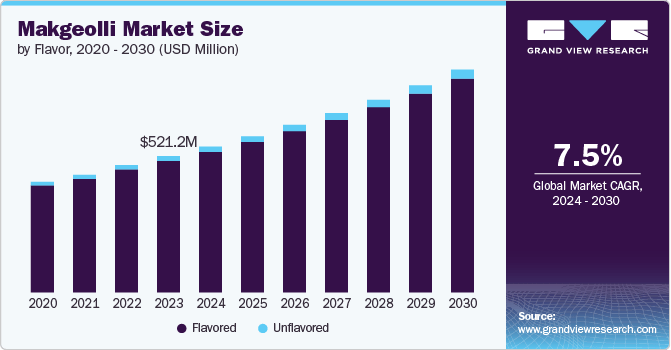

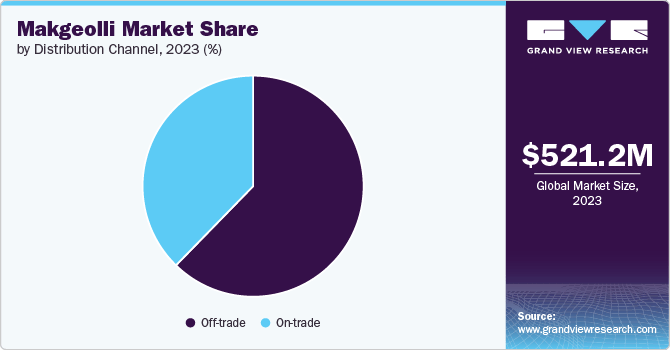

The global makgeolli market is on a steep upward trajectory. In 2023, it was valued at approximately $521.2 million, with projections estimating it will surpass $1 billion by 2033, growing at a CAGR (Compound Annual Growth Rate) of 7.5%.

Why Is Makgeolli Gaining Popularity in the U.S.?

1. Health-Forward Fermentation

- Rich in probiotics and live cultures

- Gluten-free, low-alcohol (typically 5-6%)

- Unfiltered nature gives it a wholesome, natural appeal

- No artificial additives or high processing

This aligns perfectly with the wellness-centric mindset of today’s consumers. The cloudy, rustic look of makgeolli — once seen as unsophisticated — is now embraced as a sign of authenticity.

2. A Cultural & Emotional Experience

- Makgeolli is more than a drink; it’s a cultural encounter.

- Consumers are not just buying alcohol — they’re buying a Korean experience.

- Gen Z and Millennials increasingly seek products that reflect their identity and lifestyle.

Localization as the Key to Market Penetration

For makgeolli to succeed globally, especially in competitive markets like the U.S., it must be more than a traditional export. It requires:

- Modern packaging

- Sleek branding

- Strategic distribution

- Cultural relatability

Let’s take a look at two brands executing this localization strategy exceptionally well:

Hana Makgeolli vs. 🇺🇸 Màkku: A Tale of Two K-Drinks

These two brands represent complementary approaches to bringing makgeolli to a Western audience.

1. Brand Overview

| Attribute | Hana Makgeolli | Màkku |

|---|---|---|

| Founder | Alice Jun (brewer lineage) | Carol Pak (ex-AB marketer) |

| Founded | 2017 | 2018 |

| Location | Brooklyn, NY | New York City |

| Product Format | Bottled (Traditional) | Canned (RTD – Ready To Drink) |

| Features | Organic rice, handcrafted | Flavored, sparkling, trendy |

| Target Market | Natural wine enthusiasts | Gen Z/Millennial drinkers |

Hana focuses on traditional integrity and small-batch brewing, appealing to the artisanal wine crowd. Màkku, on the other hand, takes a playful, pop-culture-savvy route with canned beverages and bold flavors.

2. Industry Trends Boosting K-Alcohol

- K-alcohol rising alongside K-beauty and K-food

- RTD (Ready-To-Drink) beverages growing 12–15% annually (Statista)

- Expansion into Whole Foods, Eataly, independent wine shops, and Asian markets like H-Mart

- Natural wine movement aligning with fermented drinks

3. Estimated Revenue Growth (2019–2023)

| Year | Hana Makgeolli | Màkku |

|---|---|---|

| 2019 | $250K | $500K |

| 2020 | $500K | $1M |

| 2021 | $850K | $2M |

| 2022 | $1.3M | $3.2M |

| 2023 | $2.1M | $5.5M |

Màkku’s aggressive RTD strategy paid off with rapid growth. Meanwhile, Hana steadily built a premium identity, gaining respect in high-end circles.

4. SWOT Analysis

| Factor | Hana Makgeolli | Màkku |

|---|---|---|

| Strength | Authentic fermentation, artisanal | Mass appeal, trendy design |

| Weakness | Limited distribution, high cost | Lacks traditional credibility |

| Opportunity | Rising demand for premium fermented drinks | RTD & cocktail mixers in demand |

| Threat | Low brand awareness, capacity issues | Price war, competition intensifying |

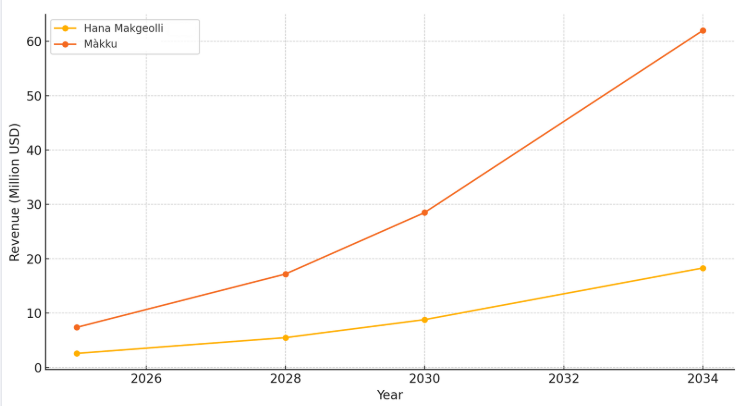

5. 10-Year Growth Projection (2025–2034)

| Year | Hana Makgeolli | Màkku |

|---|---|---|

| 2025 | $2.6M | $7.4M |

| 2028 | $5.5M | $17.2M |

| 2030 | $8.8M | $28.5M |

| 2034 | $18.3M | $62.0M |

Hana is poised to become the “natural wine” of Korea, while Màkku may lead the RTD revolution in the Asian alcohol category.

Strategic Priorities for Future Growth

Health x Variety

- Develop vegan-certified, low-sugar, low-ABV versions

- Explore diverse flavor palettes: peach, grapefruit, ginger

Aesthetic Design & Packaging

- Canned formats resonate with younger demographics

- Clean, minimalist branding increases shelf appeal

Targeted Marketing Approaches

- Cross-cultural food pairings, not just with Korean dishes

- Collaborations with chefs, influencers, lifestyle brands

- Engaging content for TikTok, Instagram, and YouTube Shorts

Makgeolli Is Not Just Alcohol — It’s an Experience

Makgeolli is no longer just a traditional Korean drink. In the U.S., it’s evolving into:

- A symbol of culture

- A health-conscious choice

- A tool of self-expression

Brands like Hana Makgeolli and Màkku demonstrate that a thoughtful blend of tradition and innovation can appeal to both connoisseurs and casual drinkers alike. Their dual-track strategies — premium versus mass appeal — show that K-makgeolli is not just surviving but thriving in global markets.

Over the next decade, we anticipate continued growth driven by:

- Wellness-meets-alcohol innovations

- Ethical consumption (vegan, gluten-free)

- Social-media-driven emotional storytelling

- Multicultural food pairings

Now is the perfect time for brands to enter the U.S. market — not just to sell a drink, but to share a story. A story of identity, craftsmanship, and cross-cultural resonance.

In the new era of global beverages, makgeolli isn’t just “a drink from Korea” — it’s a modern, emotional experience ready for the world.

It’s no longer about exporting a product. It’s about exporting a lifestyle.

Let’s raise a glass — to the future of K-alcohol.

Leave a comment