AI, Electric Vehicles, and a Shifting Market Landscape

As June 2025 kicks off, the U.S. economy is witnessing a powerful convergence of technology, employment data, and shifting investor sentiment. From AI integration in operating systems to the race for affordable EVs and record-breaking tech earnings, here are the Top 5 economic news stories shaping the U.S. market in the first week of June.

1. Microsoft Unveils Windows 12 Beta with Built-in ChatGPT

Microsoft officially released the Windows 12 beta to a group of developers, making headlines with its native integration of ChatGPT-powered Copilot AI. The new OS redesigns productivity around AI tools, embedding them directly into the desktop experience.

📌 Why It Matters:

- Signifies a mainstream leap for AI in everyday computing

- Central to Microsoft’s strategy to expand its Azure AI ecosystem

- Introduces a new standard for user interfaces and productivity workflows

This is more than a product update—it’s a paradigm shift in how people interact with technology.

2. Tesla to Launch $25,000 EV Model in 2026

Elon Musk confirmed during Tesla’s investor meeting that the company will launch a $25,000 electric vehicle in 2026. The announcement temporarily boosted Tesla’s stock price and signals a strategic push into more affordable vehicle segments.

📌 Why It Matters:

- Tesla aims to regain global market share

- This undercuts competitors like China’s BYD and VW Group

- Represents a turning point in the mass adoption of EVs

With pricing aligned to mass-market consumers, the EV revolution is about to scale even further.

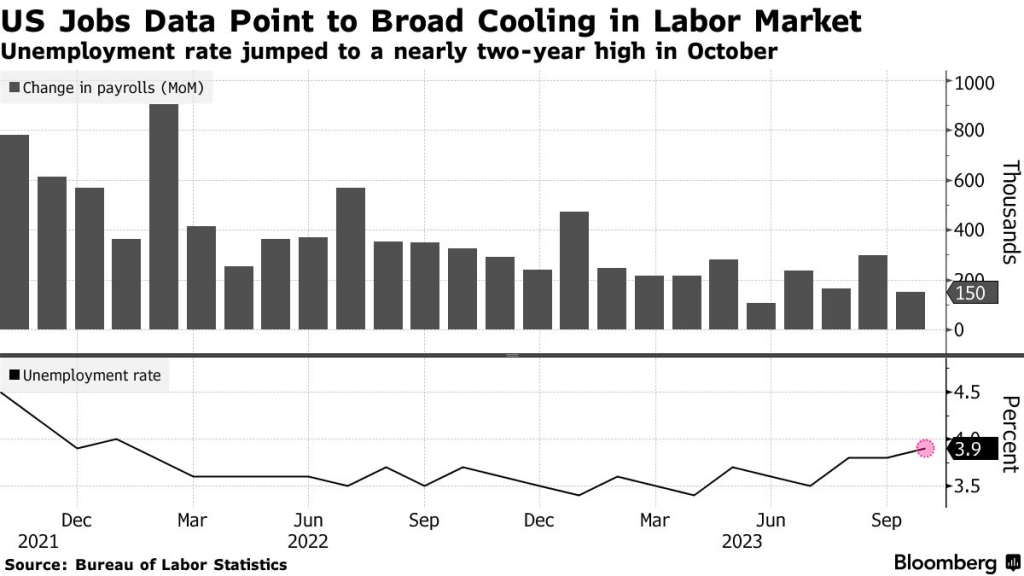

3. U.S. Unemployment Rises Slightly to 3.9%

According to the Department of Labor, the U.S. unemployment rate ticked up from 3.7% to 3.9% in May. Job creation also fell short of expectations, prompting speculation about a potential interest rate cut by the Federal Reserve later this year.

📌 Why It Matters:

- Could trigger monetary policy shifts in the form of a September rate cut

- Markets may react with renewed risk-on sentiment

- A subtle signal of a cooling labor market

As inflation stabilizes, this job data could act as a catalyst for a monetary easing cycle.

4. NVIDIA Shatters Earnings Expectations, Hits $3.6T Market Cap

NVIDIA released its Q1 2025 earnings report, exceeding both revenue and profit estimates, driven by overwhelming demand for AI chips. The company’s market cap briefly hit $3.6 trillion, temporarily surpassing Apple.

📌 Why It Matters:

- Validates real, sustained demand for AI infrastructure hardware

- Fuels growth in semiconductors, cloud services, and edge computing

- Suggests long-term structural change in the tech sector

NVIDIA is no longer just a chipmaker—it’s the backbone of AI’s future.

5. NASDAQ Hits All-Time High Fueled by AI Stocks

On June 5, the NASDAQ hit a new all-time high, driven by soaring shares of tech giants like NVIDIA, AMD, and Microsoft. The rally signals renewed optimism around long-term tech growth, especially in AI.

📌 Why It Matters:

- Investors are back in risk-on mode

- Confirms AI as a core investment theme, not just hype

- Indicates recovery in tech valuations after previous cycles

The stock market’s AI-driven resurgence has pushed the tech sector back into the spotlight.

Quick Summary Table

| Rank | Headline | Key Companies | Why It Matters |

|---|---|---|---|

| 1 | Windows 12 Beta with ChatGPT | Microsoft | AI enters daily computing |

| 2 | Tesla’s $25K EV Model | Tesla | EVs enter the mass market |

| 3 | Unemployment Rises to 3.9% | – | Rate cut expectations increase |

| 4 | NVIDIA Breaks Records | NVIDIA | AI chip demand accelerates |

| 5 | NASDAQ Hits Record High | Multiple tech firms | AI stocks lead market rebound |

“Technology, EVs, and a New Market Cycle”

The first week of June 2025 marks a clear inflection point for the U.S. economy.

- AI has gone from enterprise-only to everyday use with Windows 12.

- EV affordability is now a global strategy, not just a concept.

- Labor market shifts hint at possible policy easing ahead.

- Tech stocks are back, driven by real earnings and real innovation.

👉 For investors and business leaders alike, this is the time to watch closely.

The macroeconomic narrative is no longer about survival—

It’s about strategic positioning for the next cycle of growth.

Leave a comment