These days, I’ve really come to feel just how fast autonomous driving technology is advancing. As a proud Tesla owner, I experience its features firsthand every day, and I can't help but look forward to a world where driving becomes not just easier—but significantly safer.

When we talk about the era of autonomous driving, it’s not just about innovation. It’s about reshaping how we live. Self-driving cars can reduce traffic accidents caused by human error, ease congestion, cut travel time and energy waste, and open up mobility to the elderly and disabled who might not otherwise be able to drive.

There’s also the potential for a dramatic drop in car-related crimes—like drunk driving, road rage, hit-and-runs, and reckless behavior—once we take human drivers out of the equation. That’s why I wholeheartedly welcome the push toward full autonomous freedom.

Lately, I’ve been intrigued by news that Elon Musk plans to launch Tesla’s robo-taxi service in Austin, Texas. What makes Tesla’s model different from competitors like Waymo or Baidu is its flexibility: owners can use the vehicle for personal driving and rent it out as a taxi when not in use. While regulatory hurdles may slow things down, given Tesla’s rapid advancement and wide market penetration, I believe robo-taxi adoption is only a matter of time.

With all this in mind, I started diving deep into the world of robo-taxis. What technologies power them? How will they impact our daily lives? Here’s what I’ve found—from the U.S. industry landscape to future trends.

What Is a Robo-taxi?

A robo-taxi is a driverless vehicle designed to transport passengers via full autonomous driving capabilities. These vehicles typically operate at Level 4 or higher, as defined by the SAE (Society of Automotive Engineers), meaning they can navigate roads without any human input under defined conditions.

Here’s a quick breakdown of SAE’s autonomous driving levels:

- Level 0: No automation; the human driver controls everything

- Level 1–2: Partial assistance (e.g., adaptive cruise control); driver still monitors

- Level 3: Conditional automation; the car can drive itself but the driver must be ready

- Level 4: High automation; no driver input needed in geofenced or specific areas

- Level 5: Full automation; no human driver required, in any condition or area

Robo-taxis require a complex tech stack: Lidar sensors, AI-powered cameras, 360-degree perception, real-time mapping, and high-speed data processing. They also depend on city infrastructure and integrated systems to operate smoothly—this isn’t just about a smart car; it’s about smart cities.

Market Growth: $38.9 Million Robotaxi Market growth and $700 Billion Mobility Revolution

According to Research and Markets, the global autonomous mobility market is expected to reach $38.9 Million by 2030, that’s an annual growth rate of over 90.2%.

Moreover, according to Boston Consulting Group (BCG), the global autonomous mobility market is expected to reach $700 billion by 2030, with robo-taxis alone accounting for $38 billion. That’s an annual growth rate of over 60%.

This boom isn’t driven by car sales—it’s about mobility-as-a-service (MaaS). Instead of owning a car, people will hail rides from fleets of autonomous vehicles. For companies, this means long-term revenue through shared mobility platforms, subscriptions, and usage-based services.

U.S. Market Leaders: Waymo vs. Tesla

Waymo

Waymo, a subsidiary of Google’s parent company Alphabet, is arguably the furthest ahead in real-world robo-taxi operations.

- Service Areas: San Francisco, Phoenix, Los Angeles

- Fleet Size: Around 700 vehicles

- Weekly Paid Rides: Approx. 150,000

- Expansion Plans: Trial in Miami (2025), commercial launch (2026)

Waymo retrofits existing electric vehicles with self-driving hardware but keeps the steering wheel and pedals intact. This helps them comply with current Federal Motor Vehicle Safety Standards (FMVSS). Their approach allows for broader deployment without major legal roadblocks.

Tesla

Tesla, on the other hand, is pursuing a vision-only system, using cameras (without Lidar or radar) to perceive the environment. While more cost-effective, this system can struggle under poor lighting or weather conditions.

- Upcoming Model: Cybercab (expected 2026)

- No pedals/steering wheel: Not FMVSS-compliant, limited to 2,500 vehicles per year for now

The NHTSA (National Highway Traffic Safety Administration) is currently investigating Tesla’s Autopilot and FSD systems due to four recent crashes, potentially caused by sunlight glare, fog, or airborne particles. The findings could impact public trust and regulatory approval.

Waymo Deep Dive: From Google Project to Global Mobility Player

1. Company Overview 📌

- Name: Waymo LLC

- Founded: Initially part of a DARPA team in 2004, became a Google self-driving car project in 2009, and officially spun out as Waymo under Alphabet Inc. in 2016.

- Headquarters: Mountain View, California

- Leadership: Co-CEOs Dmitri Dolgov & Tekedra Mawakana

- Core Business Areas:

- Waymo One – Autonomous robo-taxi service (commercial ride-hailing)

- Waymo Via – Autonomous trucking and freight operations

- Technology Licensing – Selling sensor and autonomous software stacks to partners

Revenue Model:

- Paid ride-hailing services in urban areas

- Licensing technology to OEMs and logistics companies

- Strategic joint ventures (e.g., Uber, freight carriers)

2. Revenue & Growth Analysis 💰

- Total Funding: Approx. $11.1 billion as of 2024

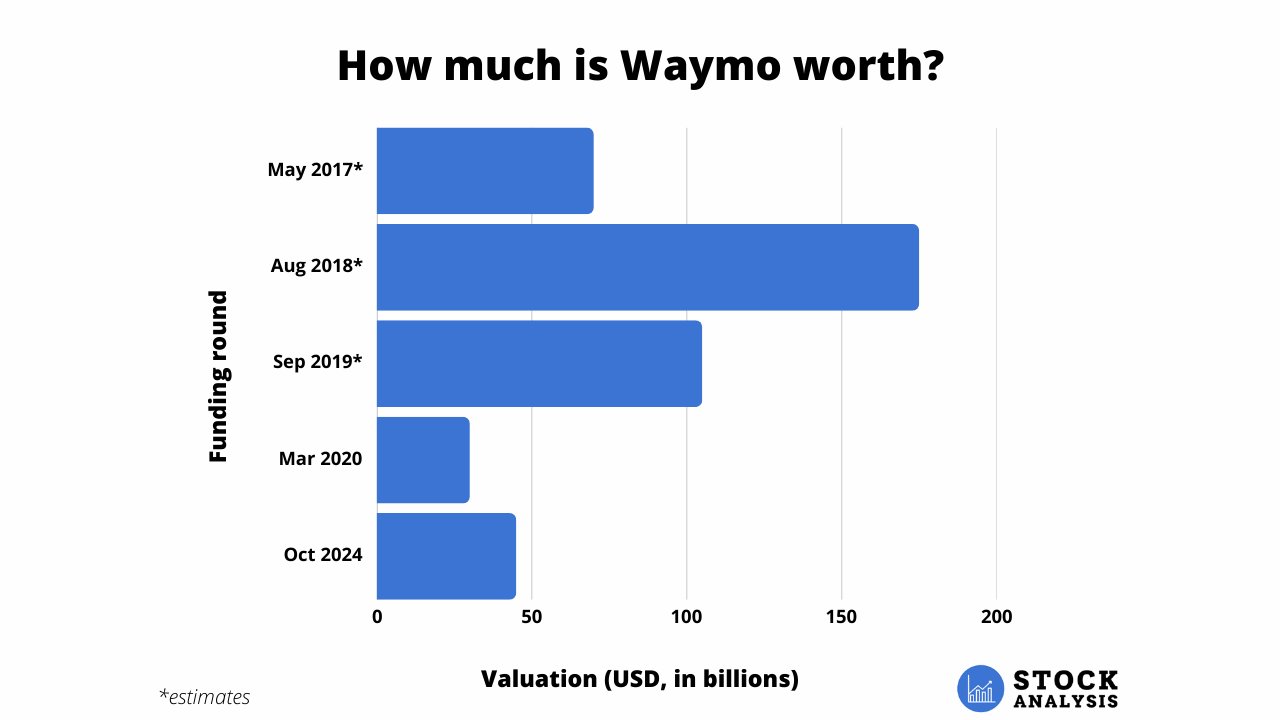

- Valuation: Estimated at $45 billion, following a $5.6B fundraising round in 2024

📍 Operational Milestones:

- 2020: Launched paid robo-taxi service in Phoenix

- 2023: Reached 100,000 rides/week

- 2025 (Projected): Expected to exceed 250,000 rides/week

📈 Growth Trajectory:

| Year | Weekly Rides | Growth |

|---|---|---|

| 2020 | ~5,000 | Baseline |

| 2023 | 100,000 | 20x |

| 2025 | 250,000+ | 150%+ YoY |

- Revenue Forecast for 2025: Approx. $181 million

- Phoenix: $76M

- San Francisco: $64M

- Los Angeles & Others: ~$40M

(Source: Morgan Stanley)

3. Profitability Analysis

- Estimated Revenue per Vehicle:

- 100,000 rides/week → 5.2M rides/year

- $15 per ride → ~$78,000 per car/year

- Operating Costs per Vehicle (Est.):

- 2022–2023: $100K–150K/year

- New Generation 2 platform rollout is expected to reduce costs to < $50K/year

- Profitability Outlook:

- Currently unprofitable per vehicle, but rapidly improving unit economics

- Break-even expected by 2026–2027

4. Financial Ratios & Capital Structure

| Metric | Value |

|---|---|

| Valuation Multiple | $11.1B invested vs. $45B valuation = 4.1x |

| EV/Revenue (2025) | ~250×, placing Waymo in the top 10% of high-growth pre-IPO tech |

| Funding Sources | Silver Lake, Andreessen Horowitz, Alphabet Inc. (parent company) |

5. SWOT Summary

| Category | Highlights |

|---|---|

| Strengths | Deep Alphabet backing, extensive real-world deployment (Phoenix, SF), advanced AI/ML stack |

| Weaknesses | Still unprofitable, high vehicle cost, limited multi-city expansion |

| Opportunities | Expansion into new cities, AI-powered ride optimization, logistics sector growth |

| Threats | Regulatory uncertainty (e.g., NHTSA, DMV), safety perception, strong rivals like Tesla FSD, Cruise |

6. Competitor Comparison

| Company | Key Differentiator |

|---|---|

| Waymo | Early mover advantage, software maturity, proven city deployments |

| Cruise (GM) | Aggressive scaling in U.S. cities, strong OEM backing |

| Aurora | Trucking-focused, aiming at long-haul logistics |

| Tesla | Vision-only stack, vertical integration, no Lidar dependency |

7. 10-Year Strategic Outlook (2025–2035)

| Milestone | Forecast |

|---|---|

| 2025 | ~$180M in revenue, 250K+ weekly rides |

| 2026–27 | Break-even on unit economics |

| 2030 | Operations in 10+ cities, $1B+ in annual revenue |

| 2035 | IPO potential or Alphabet reintegration, fully automated fleet with minimal remote oversight |

8. Conclusion

📈 Waymo is rapidly scaling in both ride volume and revenue potential.

While not yet profitable, cost efficiencies and network growth could push it to break-even within the next 2–3 years.

⚠️ High investor expectations are baked into its $45B valuation, meaning flawless execution is essential.

🔍 Key to success: Achieving cost-efficient, scalable robo-taxi operations with strong ride frequency in dense markets.

What Real Users Say: “Smoother Than Driving Myself”

A Silicon Valley engineer who rode a Waymo car in San Francisco shared:

“I was worried I’d get motion sickness, but it was actually smoother than when I drive myself. I also loved not needing to make small talk with a driver.”

Such feedback suggests that early concerns about jerkiness or strange behavior are being addressed, and that contactless, quiet travel appeals especially in the post-COVID world.

Tech, Safety, and Law

1. Technical Barriers

- Sensor limitations in rain, fog, or dust

- AI decision-making in unpredictable situations

- High-speed data processing requirements

2. Regulatory Hurdles

The FMVSS, designed around human-driven vehicles, doesn’t account for cars without steering wheels or pedals. Tesla’s Cybercab model doesn’t meet current safety standards, so it’s restricted to a small production batch unless rules change.

Waymo sidesteps this by modifying traditional vehicles, avoiding regulatory clashes—at least for now.

Privacy Concerns: Always Watching?

Robo-taxis collect vast amounts of data, from passenger locations to onboard audio and video. According to Waymo:

- Cameras: Always recording

- Microphones: Activated only during emergencies

- Data Use: Specified in their terms of service

However, Google has previously faced lawsuits for collecting user data even in Chrome’s Incognito Mode, raising doubts about how data from autonomous vehicles might be used or misused in the future.

Societal & Economic Impacts of Robo-taxis

- Reduced Accidents: No drunk or distracted driving

- Less Traffic Congestion: AI chooses optimal routes

- Eco-Friendly Cities: Most robo-taxis are electric

- New Jobs: Fewer drivers, more tech & operations roles

- Smarter Urban Planning: Fewer cars = more space for people

Robo-taxis don’t just change how we commute—they could reshape entire cityscapes, reduce pollution, and make mobility universally accessible.

Conclusion: Robo-taxis Are Inevitable

The U.S. robo-taxi industry is already transitioning from experiment to real-world application. While technical limitations and regulatory bottlenecks remain, the pace of progress is astonishing.

Tesla’s upcoming Cybercab, Waymo’s steady expansion, and the Korean government’s strategic push all suggest one thing: robo-taxis are no longer science fiction.

In the next decade, our cities, economies, and daily routines may look drastically different—and it’ll all start with an empty driver’s seat.

Leave a comment