Trump’s Pharmaceutical Tariff Policy — What’s Really Happening in the U.S.?

A few days ago, I stopped by my local pharmacy, just as I usually do. I was simply trying to buy my regular blood pressure and digestive medications, but the first thing the pharmacist said was,

“It’s been really hard to get medications these days.”

I had never felt the impact of a drug shortage quite like this. What I had only seen on the news as “pharmaceutical supply instability” had suddenly entered my everyday life. So, what exactly is going on?

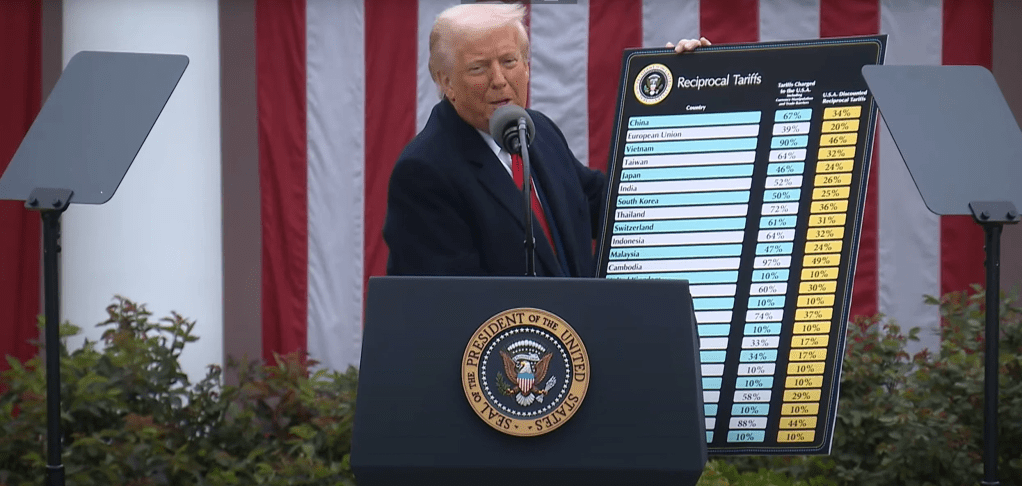

Former President Donald Trump has returned to the political spotlight and is rolling out a series of economic and trade policy announcements. Most notably, he has introduced plans to impose import tariffs on pharmaceutical products and drastically lower drug prices.

He stated:

“We must establish tariff barriers to revive the American pharmaceutical industry.”

In other words, he intends to use tariffs as leverage to force pharmaceutical production bases back to the U.S., increase domestic job creation, and reduce reliance on foreign imports—particularly from countries like China and India. On the surface, this appears to be an extension of the “America First” policy. However, many experts argue that this policy is trapped in a short-sighted perspective.

For consumers, this could mean immediate increases in drug prices, shortages of prescription medications, and reduced inventory in pharmacies. In fact, more and more people are returning home empty-handed after hearing “we’re out of stock.”

At this very moment, the U.S. pharmaceutical supply chain is being violently shaken. The question is, will this all end as a political statement, or is there a long-term strategic intent capable of reshaping the entire global pharmaceutical market?

This article will calmly examine the essence of the current pharmaceutical tariffs and drug price policies unfolding in the U.S., the strategic motives behind them, and the reactions from both markets and industry.

Trump Administration’s Policy: Lowering Prices and Imposing Tariffs

Former President Trump is pushing forward a comprehensive plan that includes high tariffs on imported drugs, executive orders for drug price reductions, and a reshoring strategy for pharmaceutical supply chains—all based on his long-held view that “American drug prices are too high.”

📌 Key Summary:

- Lower U.S. drug prices to the lowest level among OECD nations

- Introduce Most Favored Nation (MFN) pricing policy

- Simplify approval procedures for generics and biosimilars

- Announce import tariffs on pharmaceutical products

- Set a 180-day negotiation period with pharma companies, after which enforcement measures may be imposed

- Strengthen price transparency and build mechanisms for direct transactions between patients and manufacturers

Trump criticized European advanced nations for buying expensive U.S.-developed drugs at discounted prices through government policies, effectively allowing them to benefit from America’s high R&D costs without contributing.

Industry Response: Confusion Among Distributors, Consumers, and Pharmacies

Following the announcement of the pharmaceutical tariff policy, concerns about price hikes and shortages have spread rapidly among U.S. pharmacies and consumers. According to NPR, small pharmacies are stockpiling critical drugs such as insulin and hypertension medications. One pharmacist reportedly bought a six-month supply in anticipation of further supply shocks.

Pharmacist Benjamin Jolly said,

“While I agree in principle that drugs should be manufactured in the U.S., I question whether tariffs are the right mechanism to make that happen.”

Drug Shortage Situation (based on ASHP):

- As of Q1 2025, the number of shortage-affected drugs exceeded 300

- Supply chains, which had stabilized post-pandemic, are once again under pressure

Import Surge and Shifts in Global Trade Flow

In the short term, the U.S. has seen a surge in pharmaceutical imports in response to the policy shift. According to U.S. Census Bureau data, in March 2025 alone, pharmaceutical imports exceeded $50 billion, equivalent to 20% of total imports in 2024.

Ireland, in particular, overtook China as the top surplus trade partner with the U.S. for the first time. Ireland hosts manufacturing bases for major global pharma companies and has been supplying the U.S. with massive volumes of medication—including in-demand weight-loss drugs and cutting-edge therapies.

Reshoring Supply Chains? The Harsh Reality

The Trump administration’s policy goal is clear: reduce foreign dependency and revive domestic pharmaceutical manufacturing. But the path forward is riddled with challenges.

Core Issues:

- A single pharmaceutical manufacturing plant requires $1 billion and several years to build

- While production of devices like syringes may be easier, drug manufacturing is far more complex

- Most generic drug manufacturers operate under tight margins, making U.S.-based production economically unviable

According to FDA data, 90% of prescriptions in the U.S. are for generic medications, most of which come from low-cost countries like India and China.

The Association for Accessible Medicines (AAM) unequivocally stated:

“Tariffs alone will not bring the generic industry back to the U.S.”

Policy Contradictions: Import Expansion vs. Tariff Barriers

The government’s plan to expand drug imports for price reduction purposes and impose tariffs simultaneously is a policy contradiction.

Experts warn that this confuses markets, causing major pharmaceutical companies to reconsider investment plans.

Case Study – Roche:

- In April, Roche announced a $50 billion investment in U.S.-based manufacturing and R&D facilities

- However, following the executive order on drug pricing in May, Roche indicated the plan was under review

- “If implemented, this policy could jeopardize the entire investment,” the company warned

Industry Concerns: Economic Fallout and Declining Global Competitiveness

The Pharmaceutical Research and Manufacturers of America (PhRMA) issued a statement saying the drug price policy would “threaten jobs and the economy” and might increase dependence on cheap foreign supply chains—the opposite of the intended goal.

The Biotechnology Innovation Organization (BIO) also expressed concern that importing drugs from “socialist nations like China” could pose national security risks.

Catalent (NYSE: CTLT)

Integrated Strategic Company Report

Company Overview

| Item | Details |

|---|---|

| Founded | 2007 (spun off from Cardinal Health) |

| Headquarters | Somerset, New Jersey, USA |

| Industry | CDMO (Contract Development and Manufacturing Organization) |

| CEO | Alessandro Maselli (since 2022) |

| Employees | ~18,000 (as of 2024) |

| Key Clients | Pfizer, Moderna, Johnson & Johnson, and others |

| Business Model | B2B service model for outsourced drug development and manufacturing |

📌 Name Meaning: Catalent = “Catalyst” + “Talent” – highlighting the company’s mission to accelerate innovation in life sciences through expertise.

Founding Story

Catalent was not started by a traditional founder, but was strategically carved out of Cardinal Health in 2007 and backed by Blackstone Group.

Its formation represented a shift toward specialization in outsourced drug development and delivery.

- John Chiminski served as CEO from 2009 to 2022, driving Catalent’s global expansion.

- Alessandro Maselli, formerly COO, became CEO in 2022 and is currently leading strategic restructuring and margin recovery.

Catalent is a product of strategic focus, not startup idealism — a “professionalized spin-off” built to serve a growing need in global pharma manufacturing.

Market & Industry Analysis

🌍 Market Metrics

- Global CDMO market: ~$118.6B in 2023 → ~$200B+ by 2030

- CAGR (Industry-wide): 7.4%

🔍 Key Trends

- U.S. biomanufacturing reshoring via IRA and domestic incentives

- Explosive growth in cell & gene therapy (CGT) and mRNA therapeutics

- Demand for integrated CDMO platforms and smart factories

⚔ Porter’s Five Forces

| Factor | Status |

|---|---|

| Threat of New Entrants | Low (high capex and regulatory barriers) |

| Industry Rivalry | High (Lonza, Samsung Biologics, Thermo Fisher) |

| Bargaining Power of Buyers | Medium (large pharma players dominate) |

| Bargaining Power of Suppliers | Low to Medium |

| Threat of Substitutes | Low |

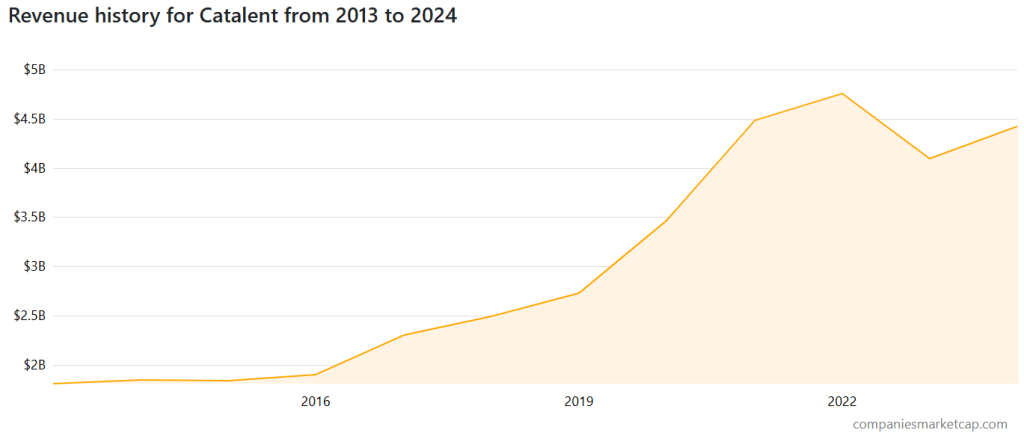

Financial Performance (2019–2023)

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Revenue ($B) | 2.52 | 3.09 | 4.05 | 4.83 | 4.28 |

| Operating Margin | 11.2% | 14.1% | 17.4% | 15.6% | 7.5% |

| Net Margin | 5.4% | 7.3% | 9.1% | 7.8% | 1.3% |

| Debt Ratio | 85% | 88% | 91% | 92% | 103% |

| Operating Cash Flow ($M) | 480 | 690 | 880 | 640 | 415 |

📉 2023 Decline Summary:

- COVID-related contracts (e.g., Pfizer vaccine) decreased

- Margin compression due to production inefficiencies

- Increased scrutiny from activist investors (e.g., Elliott Management)

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Strategic U.S. manufacturing base | Declining profitability in 2023 |

| Established relationships with big pharma | High fixed costs and production issues |

| Scalable biologics and CGT capacity | Limited margin flexibility |

| Opportunities | Threats |

|---|---|

| U.S. bioproduction reshoring | Aggressive expansion by Samsung Biologics, Lonza |

| CGT and mRNA demand growth | Investor pressure, operational risks |

Competitor Benchmarking

| Factor | Catalent | Lonza | Samsung Biologics |

|---|---|---|---|

| HQ | USA | Switzerland | South Korea |

| Strategy | Integrated CDMO (biologics + oral + CGT) | High-margin premium CDMO | Low-cost, high-volume global CDMO |

| Strength | U.S. client proximity | Specialized tech & IP | Scale, efficiency, and cost advantage |

| Notable Clients | Pfizer, J&J | Roche, Novartis | Moderna, GSK, AZ |

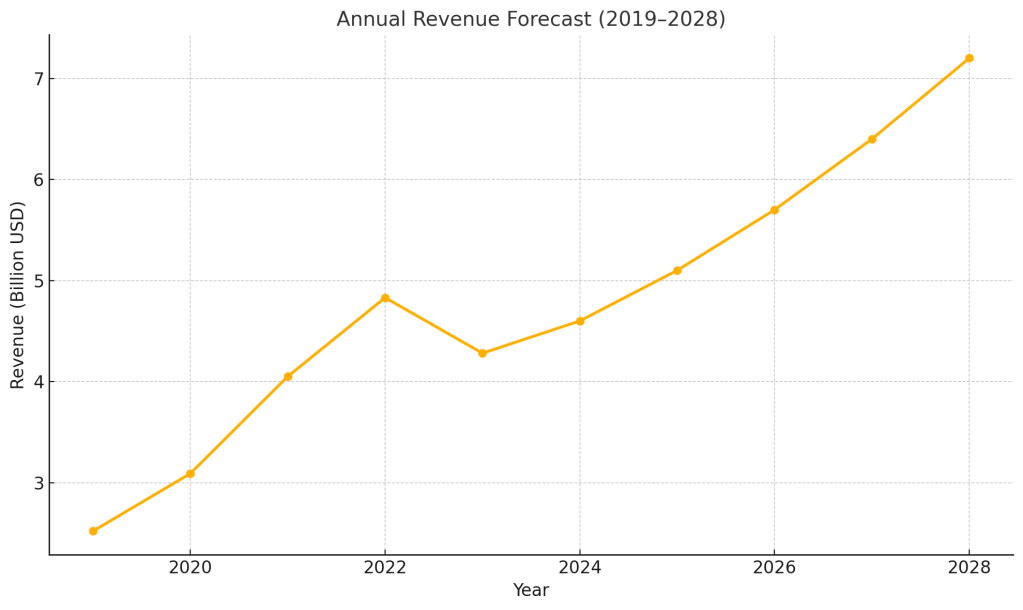

Revenue Forecast (2019–2028)

📈 Revenue Projection Table

| Year | Revenue ($B) |

|---|---|

| 2019 | 2.52 |

| 2020 | 3.09 |

| 2021 | 4.05 |

| 2022 | 4.83 |

| 2023 | 4.28 |

| 2024 | 4.6 (est.) |

| 2025 | 5.1 (est.) |

| 2026 | 5.7 (est.) |

| 2027 | 6.4 (est.) |

| 2028 | 7.2 (est.) |

Final Assessment

Catalent is a strategically positioned U.S.-based CDMO with the potential to benefit heavily from national reshoring efforts and the rise of complex biologics like CGT and mRNA therapies.

However, the company must:

- Resolve operational inefficiencies

- Improve margin performance

- Rebuild investor confidence

Conclusion: If Catalent succeeds in executing operational reforms and retains major clients, it can regain growth momentum and reclaim its leadership among global CDMOs by 2026–2028.

Global Leverage or Domestic Chaos?

Some analysts argue that Trump’s policy is less about domestic reform and more about international negotiation leverage. In fact, global pharma companies have sent warning letters to European governments, stating:

“If you don’t increase reimbursement prices, we may relocate our production facilities to the U.S.”

Former FDA Commissioner Scott Gottlieb noted:

“The U.S. could offer trade incentives to high-income countries in exchange for standardized global pricing.”

But critics warn this could undermine access to medicine in low-income countries, who may be unable to keep up with the new pricing models.

Implications for World Pharmaceutical Companies

This policy shift presents both opportunities and risks for Other world pharmaceutical and biotech firms.

✅ Opportunities:

- Simplified FDA approval for generics and biosimilars could reduce entry barriers

- Strategic expansion of CDMO partnerships and distribution networks in the U.S.

- If domestic production facilities or FDA-compliant sites are secured, firms can gain first-mover advantage

⚠️ Risk Factors:

- Tariffs could undermine cost competitiveness

- Regulatory uncertainty could delay approval processes

- Policy execution may stall due to legal disputes or federal pushback

World firms should consider portfolio restructuring, enhancing U.S. regulatory preparedness, and building adaptive strategies for policy shifts.

The Pharmaceutical Power Game Is Just Beginning

The U.S. is entering a new era of “pharmaceutical sovereignty,” aiming to lower drug prices and bring the supply chain home. But conflicting policies on tariffs, import expansion, and regulatory reforms are already causing significant market confusion.

Whether this policy evolves into a concrete national strategy or fizzles out amid legal and economic challenges remains to be seen.

One thing is clear:

👉 It is no longer time for passive observation.

It’s time for proactive strategy, risk simulation, and international coordination.

Leave a comment