Let’s be honest — dieting is a resolution that never goes out of style. Every year, millions of people renew their commitment to eating healthier, looking better, and feeling more energetic. In 2024, the public’s growing obsession with weight loss became crystal clear through the explosive popularity of GLP-1 medications like Wegovy, often dubbed a “miracle weight-loss drug.” These injections didn’t just influence pharmacy shelves — they reshaped America’s eating habits from the ground up.

As someone with a background in nutrition, I’ve always paid close attention to how new trends impact real-world eating behavior. And one term I’ve seen consistently rising in 2024 (and certainly into 2025) is blood sugar control.

The #bloodsugarcontrol hashtag on Instagram alone has surpassed 83,000 posts, and among Gen Z and millennials, new terms like “blood sugar diet” have started trending. Why? Because people are realizing that controlling post-meal glucose spikes isn’t just good for diabetics — it’s a powerful strategy for long-term weight management.

Physiologically, it makes sense. When you consume foods that keep your blood sugar stable, your body is more likely to burn fat for energy. But when blood sugar spikes — usually from high-carb snacks or sugar-heavy meals — insulin levels surge, promoting fat storage instead.

And that’s where protein-rich foods come in. Protein not only offers satiety and muscle maintenance but helps slow digestion and minimize blood sugar fluctuations. No wonder we’re seeing a huge shift in consumer preferences from sweet, carb-loaded snacks to high-protein, low-carb options.

That includes me, too — I’ve become much more mindful of how different foods affect my energy, hunger, and metabolism. Naturally, I wanted to dive deeper into this shift and understand:

How is the U.S. snacking culture evolving — and what role is protein playing in this transformation?

More importantly, could this trend represent a major growth opportunity for K-Food, especially as Korean brands look to expand into global markets with innovative, health-conscious products?

Let’s take a look at the numbers, the brands leading the change, and the rising role of functional, protein-based snacks in the American diet.

How High-Protein Snacks Are Transforming American Food Culture — and What It Means for K-Food

📉 From High-Carb to 📈 High-Protein: A Major Shift in U.S. Snack Culture

Traditionally, the U.S. snack market has revolved around high-carb, high-fat, and high-sugar items like chocolate bars, popcorn, potato chips, and crackers. But with the rapid rise of GLP-1 users, the mentality of “eating less, but healthier” is spreading fast.

The result? An explosion in demand for high-protein, low-carb, low-sugar snack products.

Top 4 Fastest-Growing Snack Categories in 2024 (U.S.)

- Greek yogurt

- Cottage cheese

- Nutritional shakes

- Jerky

Each of these is centered around protein — a clear sign of the evolving snacking trends in the U.S.

According to Nielsen, all the top growth categories in 2024 were protein-based, while traditional favorites like chocolate, popcorn, and cookies actually declined — signaling a massive cultural shift in consumer preferences.

Protein: Not Just a Nutrient — A Deciding Factor

By 2025, protein isn’t just a “nice-to-have” nutrient — it’s a leading purchase driver. Data from the global research firm Numerator shows:

- 39.3% of American consumers rank “high protein content” as their #1 factor in food choices

- That’s higher than carbohydrates, sugar, or fat

This shift is so significant that analysts expect protein-based snacks to make up over one-third of the U.S. snack market in the near future.

High-Protein Snacks: From Innovation to Mainstream

With protein becoming the new gold standard, the U.S. market is exploding with new snack innovations that combine great taste, satisfying texture, and nutritional function.

Top 3 Trending Protein Snack Brands in the U.S.

| Brand | Product | Key Features | Protein | Price |

|---|---|---|---|---|

| Immi | Protein Ramen | Premium, high-protein, low-carb noodles | 24g | $3.99 |

| Quest | Protein Chips | Doritos-like flavor and crunch, low-carb | 16g | $7.99 |

| Magic Spoon | Protein Cereal | <1g sugar, breakfast alternative | 13g | $8.99 |

These products all reinterpret traditional carb-heavy snacks with a protein-forward approach — and they’ve successfully maintained the flavor and texture consumers love, lowering the barrier to adoption.

Explosive Growth Backed by Data

The rise of protein snacks isn’t just anecdotal — it’s backed by numbers.

U.S. protein snacks market is growing, 6.4% CAGR

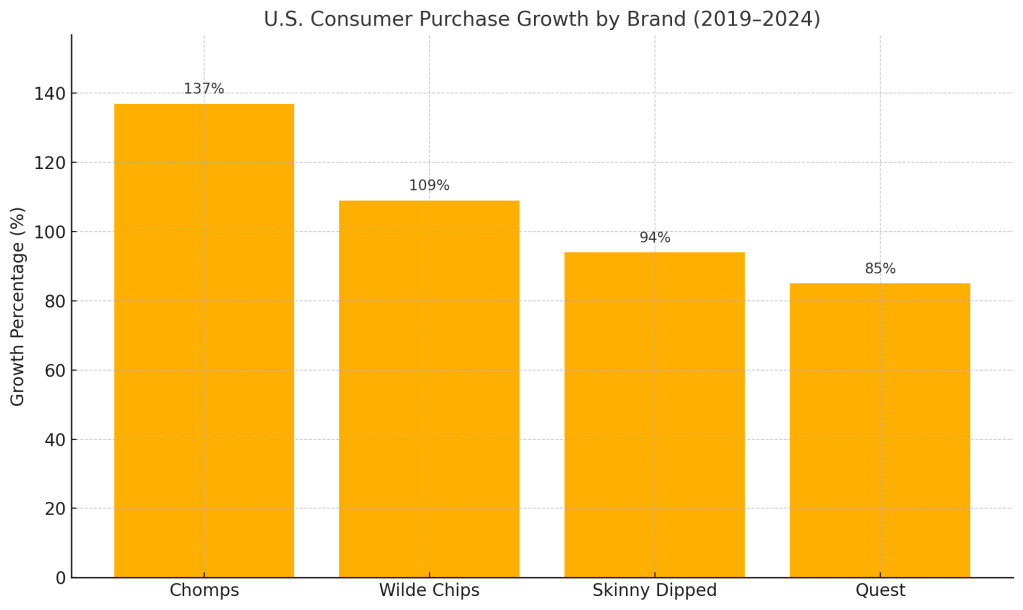

U.S. Consumer Purchase Growth (2019–2024) by Brand

- Chomps (meat-based snack): +137%

- Wilde Chips (protein chips): +109%

- Skinny Dipped (high-protein nut butter cups): +94%

- Quest (bars & chips): +85%

Clearly, protein snacks have moved beyond trend status — they’re now a core category in the American snack market.

🇰🇷 K-Food’s Opportunity in the Protein Snack Boom

This trend spells big opportunity for Korean food companies (K-Food). As Korean culture continues to rise in popularity across the U.S., combining functional health benefits with traditional Korean flavors is a smart, timely strategy.

💡Protein-Based K-Food Product Ideas

- Protein-enhanced Korean rice cakes (Tteok)

- Tteokbokki-flavored protein chips

- Tofu-based crispy snacks

- Seaweed protein chips

- Kimchi-flavored high-protein sausage

These products can resonate especially well with Gen Z and millennial consumers who value global flavors and functional health.

Pulmuone Comprehensive Business & Financial Analysis

🏢 Company Overview

Founder: Won Kyung-sun – Pioneer of LOHAS (Lifestyles of Health and Sustainability), emphasizing harmony between nature and people.

CEO: Hyo-Yul Lee – Focused on strategic international expansion and modern management.

Products:

- Tofu, soy milk, noodles, dumplings, HMR (Home Meal Replacement), plant-based snacks, plant-based yogurt

Industry: Food manufacturing and distribution, focusing on domestic and global health-conscious markets.

Revenue Model: B2C-oriented, selling packaged foods through both domestic and international channels.

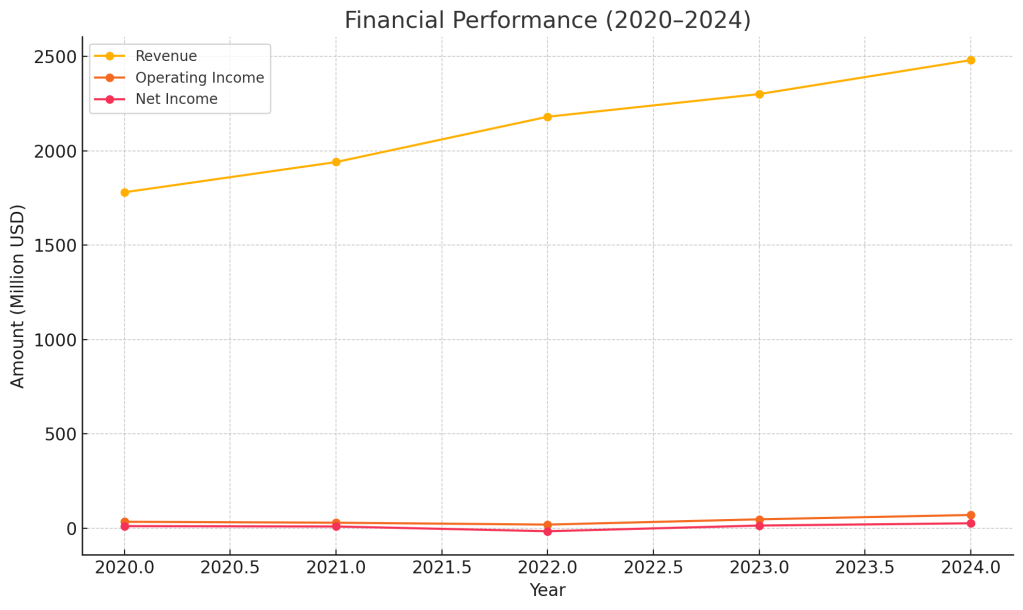

📈Financial Performance (in USD, 2020–2024)

| Year | Revenue (B USD) | Operating Income (M USD) | Net Income (M USD) |

|---|---|---|---|

| 2020 | 1.78 | 35 | 12 |

| 2021 | 1.94 | 30 | 10 |

| 2022 | 2.18 | 20 | -15 (loss) |

| 2023 | 2.30 | 48 | 15 |

| 2024 | 2.47 | 71 | 27 |

Key Ratios (2024):

- ROE: 12.4%

- Net Margin: 1.06%

- Debt Ratio: 214%

- Leverage: 3.17x

- FCF: ~$50M USD

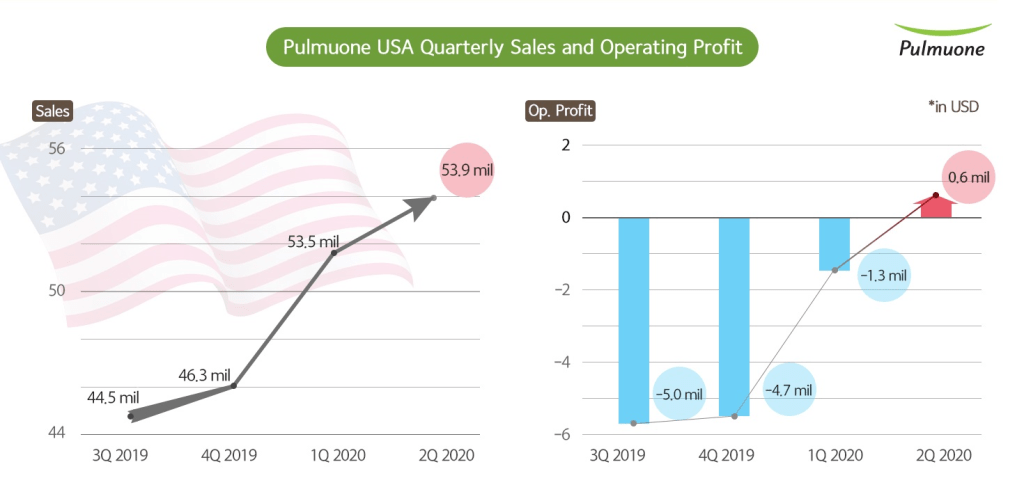

U.S. Market Performance & Opportunity

Pulmuone Foods USA:

- Headquarters: Fullerton, CA / Manufacturing: Ayer, MA & Gilroy, CA

- Leading brands: Nasoya, Wildwood, Monterey

- Annual Revenue: $53.9M~$1B

- Tofu market share in the U.S.: 75%

Growth Drivers:

- Plant-based snacks (Tofu Bars, Crisps)

- Plant-based yogurt

- Distribution via Whole Foods, Walmart, and other major retailers

Market Trends:

- U.S. plant-based food market: $8B+

- Tofu segment annual growth: 7%

- Global plant-based protein CAGR: 10.8%

SWOT Analysis

| Strengths | Weaknesses |

| – Leading U.S. tofu market share (75%)- Strong ESG and LOHAS-aligned branding- Consistent growth and stable cash flow | – High debt ratio (214%)- Limited brand recognition outside tofu category |

| Opportunities | Threats |

| – Expanding into high-value plant-based snacks and HMR- Potential expansion to European and Asian markets- Rising consumer interest in plant-based foods | – Intensifying global competition- Increasing ESG compliance costs- Raw material and supply chain volatility |

Strategic Implications

- Prioritize high-margin HMR and snack products

- Reduce leverage to enhance financial flexibility

- Expand brand recognition beyond tofu globally

- Utilize LOHAS trend with sustainable packaging and clean-label marketing

Outlook

- Expected 5–10% CAGR in U.S. sales over the next five years

- Foundation for expansion in EU and APAC through tofu/snack product lines

- Enhanced brand equity driven by sustainability-focused marketing

Go-to-Market Strategy: Trade Shows + Buyer Networking

Breaking into the U.S. market isn’t just about great taste — it’s about branding, storytelling, and building the right retail relationships.

🗣️ What American Buyers Want:

“Protein snacks will likely expand into frozen foods, bakery, and even meal kits. We’re looking for unique textures and global twists,” said a Texas-based organic snack buyer.

Key Entry Strategies for K-Food Brands

- Attend major food expos (Expo West, Fancy Food Show)

- Tailor packaging for English-speaking, health-conscious consumers

- Partner with U.S. distributors and brokers specializing in better-for-you products

- Secure certifications (Non-GMO, Gluten-Free, High Protein, etc.)

- List products on health-focused e-commerce platforms (e.g., Thrive Market, Amazon Health, Whole Foods Online)

Final Thoughts: The Era of K-Protein Snacks Has Arrived

As of 2025, the American snack market is undergoing a health-driven transformation — and at its center is protein.

GLP-1 medications may have sparked this shift, but the long-term momentum is being fueled by consumer demand for sustainable, nutritious snacking.

If Korean food brands can fuse traditional flavors with modern protein functionality, they have a real shot at becoming household names in the U.S. health food space.

Now is the time for K-Food to boldly enter the protein snack revolution.

Leave a comment