Top 5 Stories to Watch

1. CPI Report Coming Soon – Will Rate Cut Expectations Grow?

📍 Background:

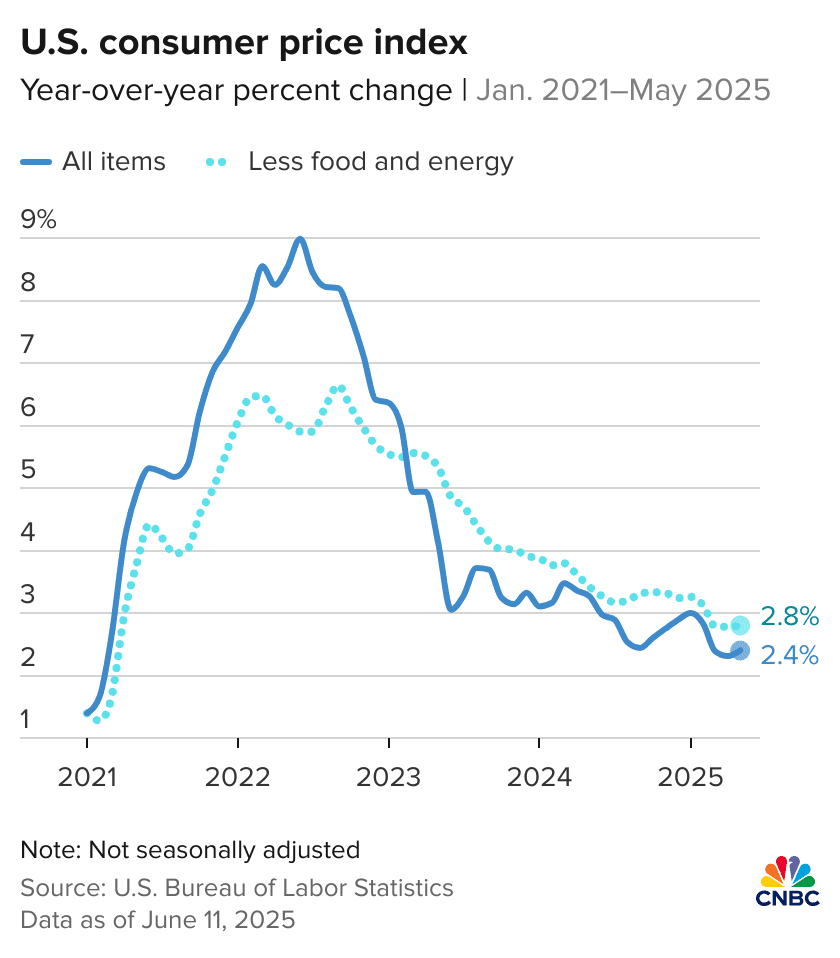

The U.S. Consumer Price Index (CPI) for May is scheduled to be released on Wednesday, June 12 (local time).

If inflation shows a clear slowdown, market expectations for a Federal Reserve rate cut in September will likely rise significantly.

📌 Why It Matters:

- Slowing inflation = bond yields drop, stock markets rise

- Could be a turning point in the Fed’s policy stance

2. Apple WWDC 2025 Incoming – Major AI Features Expected

📍 Background:

Apple’s Worldwide Developers Conference (WWDC) kicks off on Monday, June 10, where it’s expected to unveil iOS 19 and a suite of AI features under the branding Apple Intelligence.

There’s growing speculation about the extent of Apple’s partnership with OpenAI.

📌 Why It Matters:

- Apple’s entry into the generative AI race

- Could spark stock rebound and wider interest in AI-related equities

3. Rising Concerns Over U.S. Retail Spending – Target & Costco Earnings Ahead

📍 Background:

Signals of weakening consumer spending, particularly among the middle class, are emerging across the U.S.

Upcoming earnings from major retailers like Target, Costco, and Best Buy will offer clues about the real strength of consumer demand.

📌 Why It Matters:

- Slower spending = signs of economic slowdown

- Could impact Fed policy and retail sector stock performance

4. AI Chip Supply Still Tight – Watch NVIDIA & AMD Expansion Plans

📍 Background:

Demand for AI chips remains red-hot, causing supply chain bottlenecks.

NVIDIA is expanding production beyond TSMC to U.S.-based facilities, while AMD is exploring closer partnerships with Samsung.

📌 Why It Matters:

- Indicates long-term infrastructure investment in AI

- Ties into U.S. semiconductor supply chain resilience

5. Rising U.S. Interest Payments Trigger Fiscal Alarm

📍 Background:

The U.S. government’s interest expense has hit a record high, surpassing even the defense budget for FY2025.

This has reignited concerns over the country’s fiscal sustainability.

📌 Why It Matters:

- Weaker fiscal outlook could lead to dollar depreciation

- Higher bond yields and potential pressure on financial markets

Quick Summary Table

| Rank | Key Topic | Major Players | What to Watch |

|---|---|---|---|

| 1 | CPI Report | Federal Reserve | Potential rate cut signal |

| 2 | Apple WWDC 2025 | Apple, OpenAI | AI innovation reveal |

| 3 | Retail Weakness | Target, Costco | Earnings drop warning |

| 4 | AI Chip Supply | NVIDIA, AMD | U.S. chip supply chain shift |

| 5 | U.S. Fiscal Strain | U.S. Treasury | Dollar pressure, bond volatility |

📌 Key Hashtags for the Week:

#RateCut #AppleAI #ConsumerSlowdown #SemiconductorSupply #USDebtRisk

Leave a comment