These days, I can’t help but feel a little overwhelmed by how fast the world is changing. There’s virtually nowhere left without internet access — even in the middle of a jungle, atop snowy polar regions, or deep inside a war zone, people are connected to the web as if it’s the most natural thing in the world. At first, I didn’t think much of it and simply said to myself, “Well, I guess we really do live in a connected age now.”

But then, one day, I found myself wondering: “How is this even possible?”

Not long ago, I had the chance to experience the secret behind it firsthand through a device a friend showed me. A palm-sized gadget delivering seamless, high-speed internet even in a remote mountain area — I was stunned. That’s when I learned that what I was using was none other than Starlink, one of the most remarkable achievements of the booming private aerospace industry led by the United States. In that moment, I realized just how massive and almost frighteningly fast our world is evolving.

For most people, the word “space” still brings to mind science fiction movies. But in reality, at this very moment, thousands of satellites orbit the Earth, connecting even the farthest corners of the planet. Humanity is no longer content with staying bound to Earth. We are turning our eyes to the Moon and Mars, and steadily transforming the unknown realm of “space” into a tangible reality. The thought that, one day, anyone could freely travel beyond Earth to explore new frontiers is both a little frightening and incredibly exciting.

Thanks to my accidental encounter with Starlink, I came to a profound realization: the space industry is no longer just about scientific experiments. It’s a transformative force reshaping our daily lives, economy, and future. And at the center of this astonishing transformation are the private aerospace companies of the United States, industrializing the final frontier with bold innovation.

The U.S. Aerospace Industry: Growing Into a Civilian-Driven Industry

Once upon a time, “space” was nothing more than a distant dream — or at best, a government-run, highly restricted domain. Space exploration and development demanded astronomical budgets and highly specialized personnel, so only government agencies and large defense contractors could access it. Agencies like NASA (U.S.), Roscosmos (Russia), and ESA (Europe) spearheaded their respective nations’ programs as strategic national endeavors.

But in the past 20 years, American private companies have turned the entire game upside down. With revolutionary cost-cutting technologies and rapid innovation, these companies have turned space from a “dream” into an “industry,” accelerating humanity’s progress toward the stars. Today, the U.S. aerospace industry is no longer just about defense and science — it’s a global economic powerhouse full of opportunity.

The Birth of a Civilian-Led Aerospace Industry

This transformation began in the early 2000s, when the U.S. federal government opened “commercial space launch services” to private players. Pioneers like Elon Musk’s SpaceX, Jeff Bezos’s Blue Origin, and Richard Branson’s Virgin Galactic entered the scene. Unlike the government’s monopoly model, these companies maximized efficiency, slashed costs, and created entirely new markets.

The arrival of private players lowered the barriers to entry, enabling universities, startups, and even governments of developing countries to launch satellites and access space services. Space was no longer just a “national asset” — it became the center of an open industrial ecosystem.

The Reusable Rocket Revolution Sparked by SpaceX

The most symbolic innovation of the private aerospace era is undeniably SpaceX’s reusable rockets.

SpaceX developed the Falcon 9’s first-stage booster to be reusable, dramatically reducing launch costs. Traditionally, rockets were discarded into the ocean after a single use. But SpaceX perfected vertical landing technology, enabling boosters to be recovered and reused — boosting both economic and environmental sustainability.

- Average Falcon 9 launch cost: approx. $67 million

- Internal cost with reuse: approx. $15 million

Thanks to this breakthrough, SpaceX launched over 130 rockets in 2024 alone — more than half of all global launches. Since SpaceX entered the market, satellite launch costs worldwide have fallen by 10–30%, and interest from customers and investors has soared.

The Dawn of the Private Satellite Internet Era

Beyond launch services, SpaceX created an entirely new market: “global internet based on low Earth orbit satellites.”

This is the Starlink project.

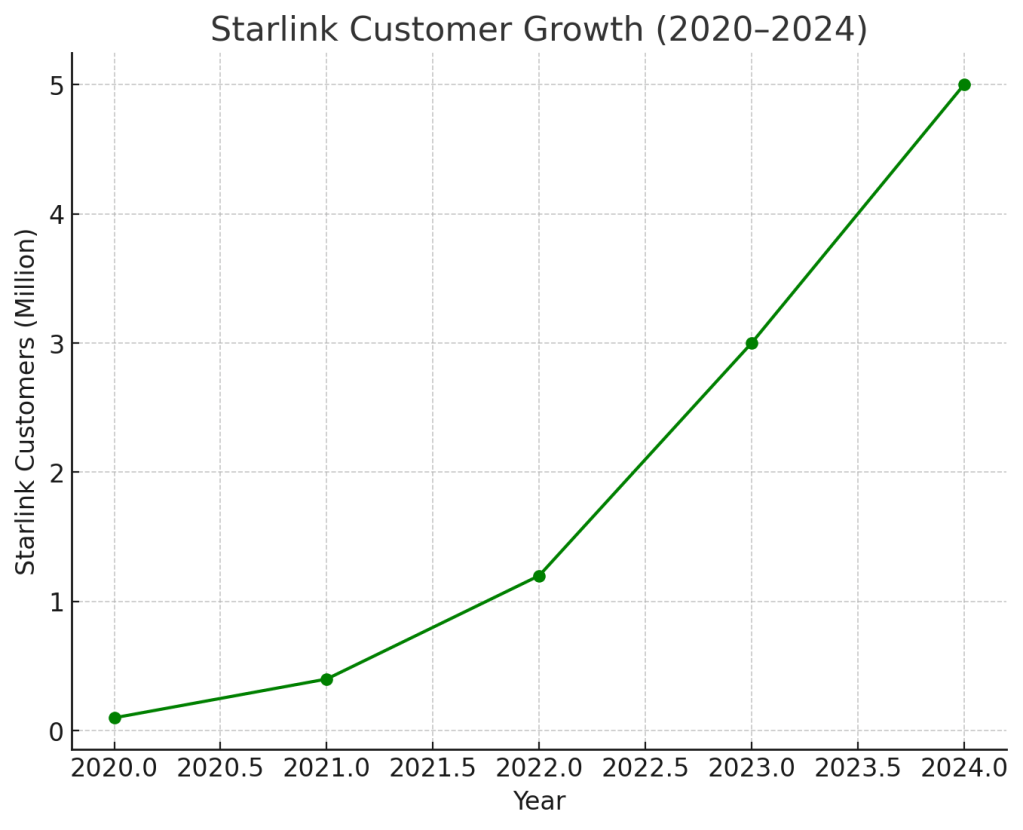

Starlink is a service that places tens of thousands of satellites in low Earth orbit (LEO) to provide high-speed internet worldwide. Previously, high-speed internet was impossible in places like polar regions, deserts, and remote islands. Starlink has shattered those limits.

- Starlink satellites launched so far: approx. 7,500

- Target deployment: approx. 42,000

Starlink even proved its value in war. During the 2022 Ukraine war, Starlink enabled military communication and humanitarian operations even when ground networks were destroyed. It showed that space-based communication is not just a luxury but a critical national security and emergency response asset.

Amazon is also developing its own service, Project Kuiper, and the market for satellite-based data services is projected to reach hundreds of billions of dollars.

SpaceX Business Analysis Report

Business Overview

| Item | Details |

|---|---|

| Founded | 2002 |

| Headquarters | Hawthorne, California, USA |

| Founder / CEO | Elon Musk |

| Industry | Aerospace, Satellite Internet |

| Key Products/Services | Falcon 9/Falcon Heavy rockets, Starship, Starlink internet, Dragon capsules |

| Revenue Model | Satellite launch services, Starlink subscriptions, government & defense contracts |

| Core Customers | NASA, DoD, commercial satellite operators, global households and enterprises (Starlink) |

Industry & Market Analysis

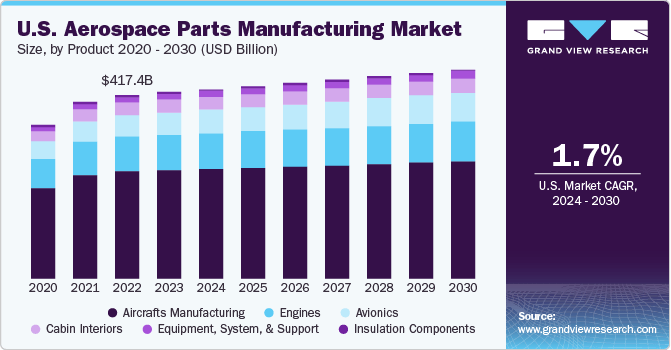

✅ Industry Growth & Market Size

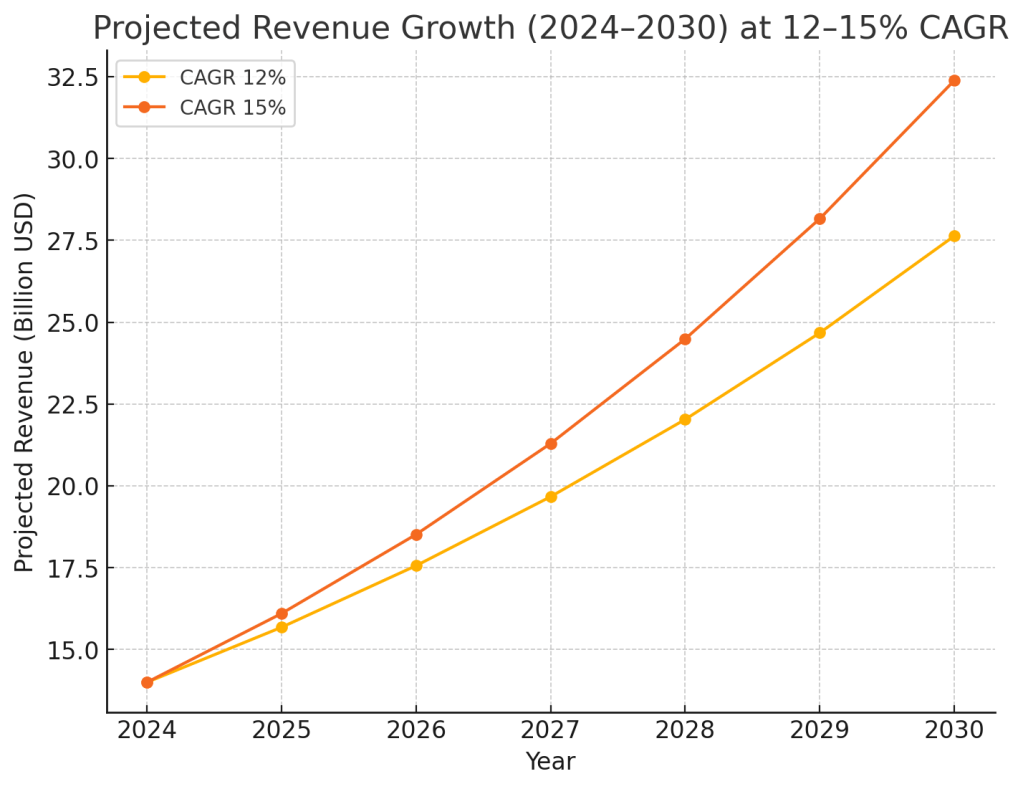

- Global satellite internet market CAGR: ~12–15% (2024–2030)

- Commercial space launch market: expected to reach $60–80 B by 2030

- Starlink revenue growth: ~50–70% YoY, leading the industry

✅ Key Trends

- Fierce competition in LEO satellite networks (Amazon Kuiper, China’s initiatives)

- Growing demand for military/government satellite services

- Increasing demand for aircraft and maritime connectivity

✅ Competitive Intensity

- Launch services: rivals include Blue Origin, ULA, China CNSA

- Satellite internet: Amazon Kuiper, OneWeb, etc.

→ SpaceX maintains leadership with early market entry and vertical integration

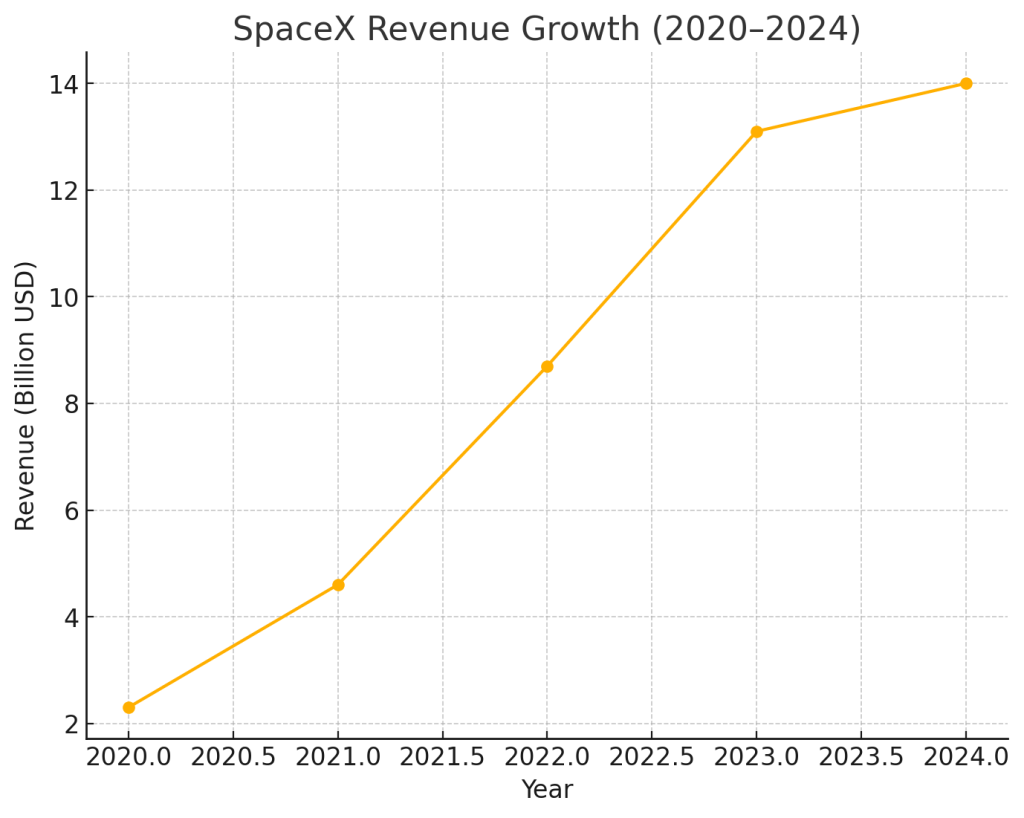

Financial Analysis (2019–2024)

| Year | Revenue | YoY Growth | Estimated Net Income |

|---|---|---|---|

| 2020 | ~$2.3B | — | Loss |

| 2021 | ~$4.6B | +100% | Loss |

| 2022 | ~$8.7B | +89% | Loss |

| 2023 | ~$13.1B | +51% | Turned profitable |

| 2024E | ~$14B+ | +7%~ | Profitable |

✅ Starlink contribution: ~50–60% of 2024 revenue

✅ 2025 revenue forecast: ~$15.5B

✅ Starlink broke even in early 2023, improving overall profitability

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Leading reusable rocket tech & cost advantage | High capital intensity & risk |

| First-mover in LEO satellite networks (Starlink) | Uncertainty in monetizing Mars projects |

| Strong government & defense contracts | Competitive pressure from latecomers |

| Opportunities | Threats |

|---|---|

| Expanding satellite internet market | Regulatory hurdles, spectrum disputes |

| Rising demand in aviation & maritime | Competition from Amazon Kuiper, China |

| New markets like space tourism & Mars | Global economic slowdown |

Competitor & Differentiation Analysis

| Item | SpaceX | Blue Origin |

|---|---|---|

| Strategy | Fast execution & innovation | Stable, long-term |

| Launch record | 100+ launches/year | No orbital launch yet, New Glenn in progress |

| Monetization | Cash flow from Starlink | Primarily government contracts |

| Technology | Reusable rockets, LEO internet | Lunar lander, space tourism focus |

SpaceX differentiation:

- Diversified revenue streams (B2B, B2C, B2G)

- Fast experimentation & execution

- First-mover advantage in Starlink & government services

Elon Musk’s Leadership Mindset

Visionary

- Focus on humanity’s multi-planetary future, Mars colonization

First Principles Thinking

- Break down problems to fundamentals and rebuild solutions

Persistence & Execution

- “Failure is an option,” relentless in pursuit of goals

Hands-on Leadership

- Involved in design, manufacturing, even hiring

Goal Sharing & Collaboration

- Believes everyone should understand and align with the mission

10-Year Growth Outlook (2025–2035)

✅ Expected CAGR: 20–30%

✅ Revenue by 2035: ~$50–100 B

✅ Starlink: expansion into telecom-like markets with direct-to-cell technology

✅ Starship: new revenue streams from lunar, Martian, and deep space projects

Summary Table

| 📊 Key Metrics | 2024 | 2035 (Estimated) |

|---|---|---|

| Revenue | ~$14B | $50–100B |

| Starlink Customers | ~5M | ~20M+ |

| Launches | ~120/year | ~200/year |

| Core Businesses | Starlink, launch services | Starlink+, space tourism, Mars settlement |

Strategic Implications:

SpaceX is positioned to maintain leadership in the space industry over the next decade by leveraging its strengths in fast execution, technological innovation, and diversified revenue streams.

Space Tourism: Taking the First Steps Toward the Mainstream

Space tourism is no longer just a science fiction fantasy.

Blue Origin and Virgin Galactic are already flying ordinary people into space.

Blue Origin

- Uses the New Shepard rocket to reach 100 km altitude

- Passengers experience weightlessness and see Earth’s curvature

- Flight duration: approx. 10 minutes

- Dozens of successful flights already

Virgin Galactic

- Offers suborbital flights using a spaceplane

- Over 700 customers already waiting

Currently, the cost of these trips remains in the hundreds of thousands of dollars, but as technology improves and economies of scale kick in, prices are expected to drop and accessibility will grow.

SpaceX is aiming even higher, pioneering true orbital tourism. In 2021, its Inspiration4 mission sent an all-civilian crew into Earth orbit for three days, and future plans include lunar orbital tours and visits to the International Space Station.

Venturing to the Moon, Mars, and Asteroids

The ultimate goal of the space industry goes beyond tourism — it’s about enabling human settlement and mining extraterrestrial resources.

The Moon is already central to NASA’s Artemis program, which aims for crewed lunar missions after 2026, working with private partners to build habitats and establish a lunar base.

Mars is seen as a longer-term target for colonization. SpaceX has already publicly outlined plans for human settlement on Mars.

Asteroid mining is another promising area, as asteroids contain vast quantities of platinum, nickel, and rare metals. Robotic mining of asteroids could help address Earth’s resource shortages in the future.

Key Takeaways: The Era of the Open, Civilian-Led Space Ecosystem

The U.S. aerospace industry has entered an entirely new phase.

It is now an “open ecosystem” driven by private companies and supported by the government.

- SpaceX: reusable rockets, Starlink, orbital tourism

- Blue Origin: suborbital tourism, lunar exploration

- Virgin Galactic: commercial spaceflights

- Amazon: entering the satellite internet market

This shift presents opportunities even for global players, including Korean companies. Components, sensors, communication modules, and data analytics all represent areas where barriers to entry are lower and new markets are emerging. As one senior aerospace engineer at a U.S. defense contractor said in an interview:

“The private space ecosystem needs more partners than ever. Companies with niche technologies — satellite components, sensors, AI-based monitoring software — can definitely break into the market.”

Outlook: Space Is No Longer “Far Away”

The future of the space industry is coming faster than we think.

Global investment is growing by double digits every year, and the U.S. aerospace market is projected to surpass $1 trillion annually by 2030.

- Satellite internet: connecting every corner of Earth

- Tourism: from luxury to mainstream

- Exploration: establishing lunar and Martian outposts

- Resources: mining beyond Earth

Space is no longer just “the distant future.” It is already here, and the opportunities are open to all who dare to reach.

Conclusion: The Challenge of Space Continues

The U.S. aerospace industry has transformed from a government-run defense program into a vast industrial ecosystem led by private companies.

Space is no longer the exclusive domain of a few scientists and engineers — it’s becoming an open arena for more companies and individuals to challenge themselves.

What remains is to turn imagination into technology, and innovation into everyday reality.

The future belongs to those who are ready — and that future is already waiting in space.

Leave a comment