These days, I often find myself amazed at how much our everyday life has changed.

Not too long ago, I remember lugging around a giant, clunky vacuum cleaner just to clean my tiny apartment. It was heavy, loud, and always a hassle to store.

Then, one day, a friend showed me her tiny, sleek, portable vacuum cleaner — cordless, quiet, and light enough to carry with one hand.

I couldn’t believe something that small could actually get the job done.

But it did. And better yet, it fit neatly in a closet.

That was my first real “aha” moment with portable devices. Since then, I started noticing how often I rely on portable gadgets — the mini projector I bring to family movie nights, the little espresso machine I pack when I travel, the wireless keyboard I use when working from a café.

The truth is, portable products have quietly become an essential part of my life — and probably yours too.

What really struck me is how these compact devices don’t just save space — they actually make my life feel more flexible and modern.

In many ways, they’re redefining how we live, work, cook, and play.

That realization got me thinking: Why have portable products become so popular, especially in the U.S.? And where is this trend heading?

In this blog post, I want to explore the rise of portable devices in the U.S. consumer market — how they’ve evolved, why they resonate with today’s lifestyles, and what it means for the future of home and work.

So let’s dive into the era of pocket-sized innovation — and see how small really can be mighty.

Why Portability is the Future in the Minimalist Era

The popularity of portable products in the U.S. is about more than just size.

Today’s consumers no longer buy products just because they’re big and expensive. Instead, they look for space-saving, practical solutions that suit their diverse lifestyles.

During and after the COVID-19 pandemic, as more people stayed home and worked remotely, demand for portable electronics skyrocketed.

In one U.S. consumer survey, 68% of respondents said that space efficiency was a key factor in appliance purchases — ranking alongside price and performance.

From young, single-person households in urban apartments to outdoor enthusiasts and digital nomads, portable products appeal to a wide range of users.

In addition, portable products are generally more affordable and have shorter replacement cycles, lowering the barrier to entry for many buyers.

The integration of smart features into portable devices has only accelerated growth.

For example, portable air conditioners, humidifiers, and electric kettles can now be controlled via smartphone apps, making them not only compact but also intelligent.

Portability is Transforming Industries

The portable revolution isn’t just changing how people live — it’s transforming industries.

Miniaturization technology has allowed manufacturers to reduce the amount of materials and components used in production, cutting costs and improving logistics.

Lighter products take up less space in warehouses and on shelves, and they’re much easier and cheaper to ship.

This is one reason why not only big corporations but also startups and SMEs are entering the portable electronics market.

📌 Key advantages of portable products:

- Lower production costs

- Flexible manufacturing (enabling small-batch production)

- Environmentally friendly (less energy and resources)

- Reduced logistics and storage costs

- Faster product launch cycles

In fact, many portable products are now designed with recyclable materials and energy-efficient engineering to align with growing ESG (environmental, social, and governance) demands.

This makes portable products even more attractive to eco-conscious consumers.

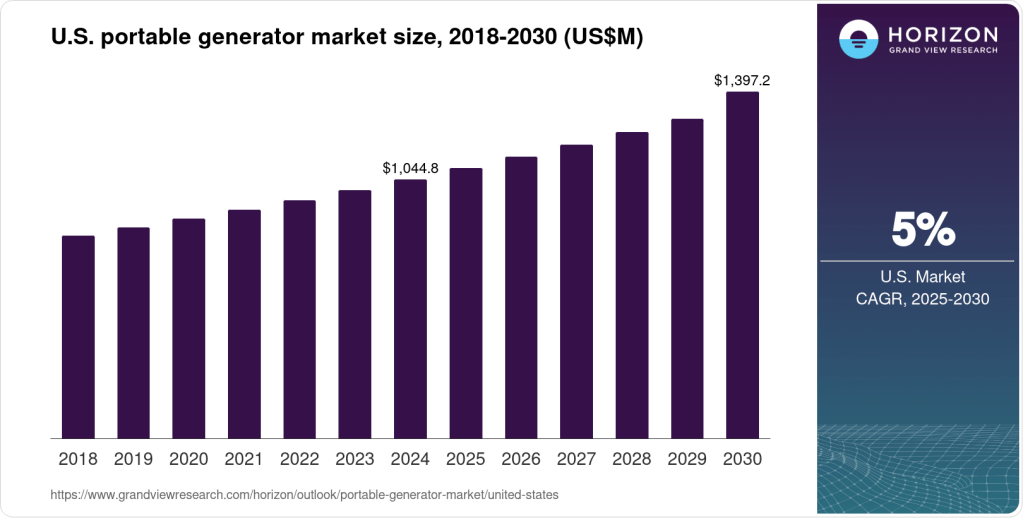

The Astonishing Growth of the U.S. Portable Market

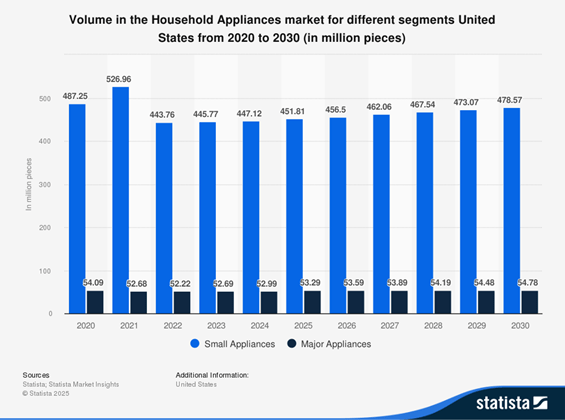

The U.S. small appliance market has grown steadily at double-digit rates over the past decade.

According to Statista, annual sales of small appliances in the U.S. are expected to reach 451 million units by 2025.

In contrast, major appliances are projected to sell only about 53 million units, and the gap continues to widen.

Average annual growth rates (CAGR) in 2024 by category:

- Personal care: 11.8%

- Home care: 10.9%

- Kitchen: 5.4%

- Cooking: 4.7%

Online retail has also fueled growth, with IBIS World predicting an 5% CAGR for small electronics over the next five years.

In 2030 alone, the U.S. portable electronics market is expected to generate approximately $14 billion in revenue.

Popular Portable Products by Lifestyle

Let’s break down the most popular portable devices in the U.S. market by category.

1️⃣ Home Appliances

Perfect for small spaces and energy-efficient living, these products are a hit among singles, students, and campers.

- Portable Fan (Gaiatop)

- Portable Washing Machine (ELVASO)

- Portable Vacuum Cleaner (Farsaw)

- Portable Humidifier (Saunana)

- Portable Air Conditioner (VEEST)

- Portable Heater (LIEWET)

2️⃣ Office Equipment

With remote work and digital nomads on the rise, portable office devices are more in demand than ever.

- Portable Monitor (BKVOO)

- Portable Printer (Gloryang)

- Portable Keyboard (Samsers)

- Portable Power Bank (Anker)

- Portable Projector (NEBULA)

- Portable Lighting (SELFILA)

3️⃣ Kitchen Appliances

The rise of camping, road trips, and personalized lifestyles has driven sales of portable kitchen devices.

- Portable Refrigerator (Zyerch)

- Portable Blender (OTPEIR)

- Portable Espresso Machine (WACACO)

- Portable Microwave (SharkNinja)

- Portable Rice Cooker (TOPWIT)

- Portable Electric Kettle (T-magitic)

4️⃣ Entertainment

These devices help people express themselves and enjoy leisure activities anywhere, anytime.

- Portable Speaker (XLEADER)

- Portable Karaoke (Caymuller)

- Portable Tripod (Camrola)

- Portable TV (Stanbyme)

- Portable Disco Light (ASFSKY)

- Portable Photo Printer (IVY)

Logitech Company Analysis Report

1. Business Overview

- Founded / Headquarters: 1981 / Lausanne, Switzerland & California, USA

- CEO: Hanneke Faber (appointed 2024, former Unilever Beauty & Personal Care President)

- Industry & Key Products/Services:

PC peripherals, gaming gear, video conferencing solutions, streaming equipment, smart home devices

Main brands: Logitech, Logitech G, Blue Microphones, Streamlabs, Ultimate Ears - Business Model:

B2C & B2B hardware sales + some software subscriptions - Core Customer Segments:

Individual consumers (gamers, creators) + businesses (video conferencing solutions)

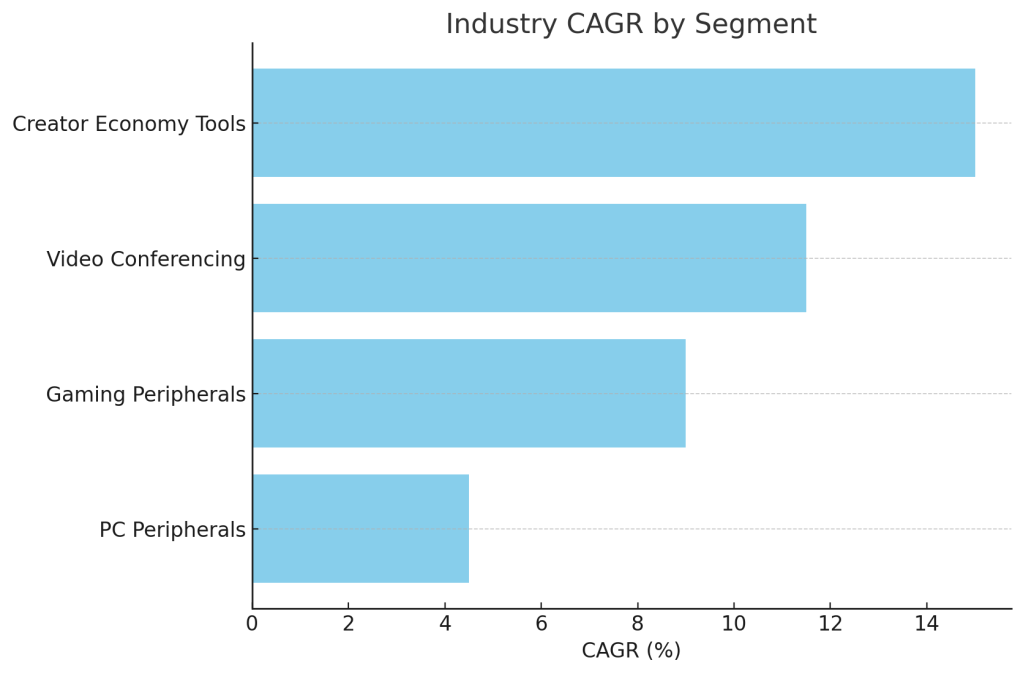

2. Industry & Market Analysis

Industry Growth & Market Size

- Global PC peripherals: peaked during COVID, normalized, long-term CAGR ~4–5%

- Gaming peripherals: 2023–2030 CAGR ~9%

- Video conferencing/UCaaS: CAGR ~11–12%, driven by hybrid work trends

- Creator/streaming equipment: small but high-growth (~15% CAGR)

Key Trends

- Sustained demand for webcams, headsets, conferencing solutions due to hybrid work and digital nomads

- Premiumization of eSports and gaming gear

- Growth of the creator economy → increased demand for microphones, capture cards

- ESG / use of sustainable materials emphasized

🏁 Competitive Intensity

- Competitors: Razer, Corsair, HP, Microsoft, Poly, Elgato, etc.

- Porter’s 5 Forces:

- Threat of new entrants: medium

- Threat of substitutes: medium

- Buyer bargaining power: high

- Supplier bargaining power: low

- Rivalry among existing competitors: very high

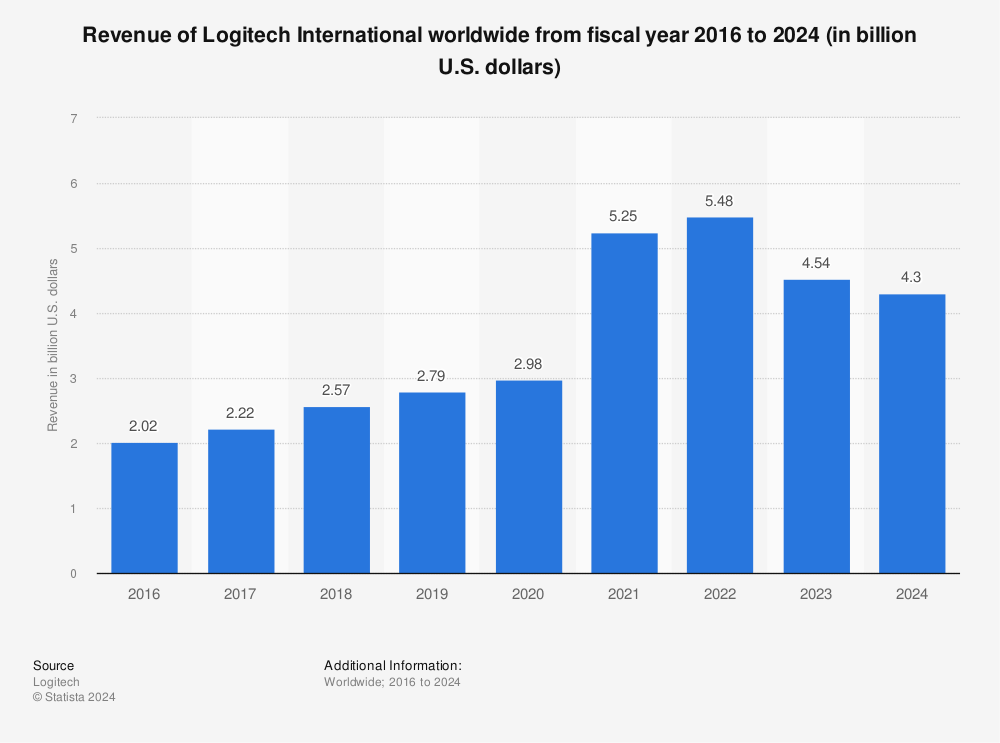

3. Financial Analysis (Profitability & Growth: Last 5 Years)

(Approx. USD figures based on public disclosures)

| Year | Revenue (B USD) | Operating Margin | Net Margin |

|---|---|---|---|

| 2019 | 2.83 | ~11% | ~9% |

| 2020 | 3.02 | ~12% | ~10% |

| 2021 | 5.03 | ~16% | ~13% |

| 2022 | 5.10 | ~14% | ~11% |

| 2023 | 4.50 | ~10% | ~8% |

| 2024 | 4.3 | ~9.8% | ~8% |

📊 Key Points:

- Significant sales surge during the pandemic (webcams, keyboards, mice)

- Slight decline in 2022–2023 as economy cooled and remote work normalized

- Long-term growth potential remains in video conferencing and gaming markets

4. SWOT Analysis

| Element | Details |

|---|---|

| Strengths | Global brand, robust distribution network, diverse product portfolio |

| Weaknesses | Mature markets, high price sensitivity, lower R&D intensity |

| Opportunities | Expansion of hybrid work, ESG-driven green products, creator market |

| Threats | Economic sensitivity, intensified price competition, PC shipment decline |

5. CEO Mindset & Philosophy (Hanneke Faber)

- Strong vision on ESG and sustainability from Unilever background

- Advocates for “consumer-centric innovation” and an “inclusive culture”

- Aims to expand environmentally friendly product lines at Logitech

- Focuses on diversity and flexibility to lead future work environments

10-Year Growth Outlook (2024–2034)

- Expected average annual revenue growth of 5–7%, driven by video conferencing, gaming, and creator markets

- Strengthening brand value through sustainability and premiumization strategies

- Opportunities in emerging markets and SaaS-based service expansion

Why Consumers Love Portable Products

✅ Affordable

In a slower economy, consumers prefer reasonably priced portable alternatives to expensive, bulky appliances.

MZ consumers especially value “trading down” without sacrificing functionality.

✅ Smart Technology

Portable devices now feature IoT and smart home integration, enabling control and automation from your smartphone.

✅ Eco-Friendly

Energy-efficient designs and recyclable materials resonate with today’s eco-conscious buyers.

The Future of Portability

The U.S. portable device market is still in its early stages of growth.

With rapid innovation and increasing demand for smart, eco-friendly solutions, the possibilities are endless.

Global exports of portable devices are also growing, opening opportunities for companies worldwide to enter the U.S. market via online platforms and partnerships.

Final Thoughts

Portable devices are no longer just “small and cute.”

They save space, improve efficiency, and make everyday life smarter.

The portable revolution that started in the U.S. is now spreading worldwide.

What portable device do you use in your daily life?

Feel free to share your favorites or recommendations in the comments.

Why not upgrade your life with compact, smart portable devices?

Leave a comment