These days, whenever I get together with friends, one topic inevitably comes up: tariffs. In the past, it was something only my friends in the steel industry or those working in international trade really cared about. But now, things are completely different. Friends who are thinking about buying a car, others who want to replace their refrigerator at home, even those just shopping for groceries at Walmart say things like: "Prices have gone up so much because of tariffs."

Many people around me work in steel and auto parts, so maybe that’s why I hear about tariffs even more often lately.

One friend who works at a factory sighed, saying, “Ever since the Trump administration imposed high tariffs on steel, it’s become so hard to keep costs under control.”

Another friend said, “I was planning to buy a new car, but I’ve given up now.”

Honestly, I never expected tariffs to seep so deeply into our daily lives.

But it’s hard to ignore now. What used to feel like some abstract “trade policy” on the news is now directly affecting my friends, their budgets, and even how they live.

That got me wondering:

How are American consumers actually changing because of tariffs?

How are different generations responding, and in what ways are they adapting?

So today, let’s take a closer look at how the U.S. high-tariff policy is reshaping consumer behavior — one wallet at a time.

Tariffs Driving Up Prices: Another Source of Inflation

According to a recent survey by McKinsey & Company, the two biggest worries on U.S. consumers’ minds today are inflation (43%) and tariff policy (29%).

This is the first time tariffs ranked so high on a survey like this, showing just how much they’ve become a part of everyday concerns.

Under the Trump administration, the U.S. imposed tariffs as high as 50% on imports of cars, steel, aluminum, and other strategic goods — extending reciprocal tariffs to imports from all over the world.

As a result, U.S. imports in March rose by $17.8 billion (4.4%) from the previous month, but by June, inventories ran out and prices began rising noticeably.

Walmart and Ford both announced price hikes in June, and major appliance makers like Samsung and LG are reportedly planning to raise prices soon as well.

According to Anderson Economic Group, small and mid-sized car prices could rise by $2,500–4,500, while luxury cars could go up by as much as $20,000.

Appliances and electronics are also under heavy upward price pressure.

How Consumers Are Responding: “Time to Close the Wallet”

As prices rise, consumers have been quick to change their habits.

McKinsey’s survey found that 63% of respondents have already changed or plan to change their spending habits.

Specifically:

- 54% plan to cut back on non-essential purchases

- 48% plan to buy less overall

- 43% plan to switch to cheaper alternative brands

In the past, consumers might have bought new cars or the latest gadgets without much thought — but now, they’re asking themselves “Do I really need this?” and choosing value over status.

How Generations Are Adapting Differently

Interestingly, the response to tariffs varies by generation.

Millennials (born 1981–1996)

- 6 percentage points more likely than average to have already changed spending habits

- 2 percentage points more likely to say they plan to change soon

Gen Z (born 1997–2010)

- Most likely to say they are “in the process of adjusting”

- More inclined to opt for used goods or downgrade to lower-priced brands, especially for big-ticket items like cars and clothing

- Show more awareness of sustainability concerns

Baby Boomers (born 1946–1964)

- Least likely to change habits

- 6 percentage points more likely than average to say they’ll “maintain current spending”

- When they do cut back, they tend to focus on eliminating non-essential purchases

These patterns show how different generations approach the same economic pressure in their own way.

Cars, Appliances… Price Increases Are Inevitable

Major U.S. automakers and retailers have already made their price increases official:

- Ford raised import car prices starting June 2

- Walmart increased prices on key items at the end of June

- Samsung and LG are preparing price adjustments

Luxury cars could see price hikes of up to $20,000, and appliances are expected to rise 10–15%.

Tariffs on steel and aluminum have pushed up raw material costs, which then ripple through to final prices.

Expert Warnings: Inflation Could Feel Like 5%

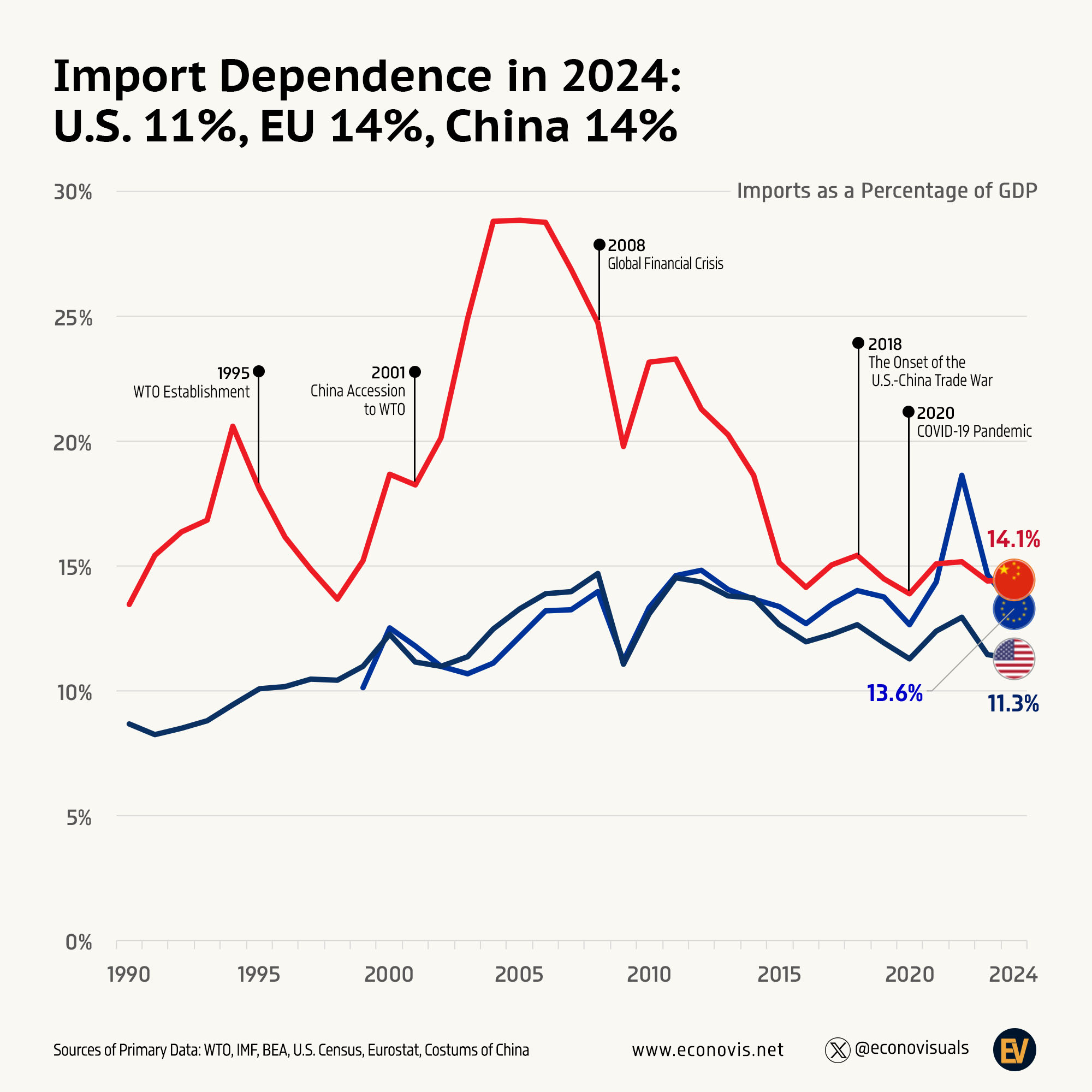

Deloitte estimates that imports account for about 11% of U.S. GDP — meaning current tariff policies could add up to 2.9 percentage points to inflation.

With inflation already at 2.4% as of May 2025, some predict that the perceived inflation rate could exceed 5%.

A consultant said:

“Tariff-driven inflation weakens household purchasing power. As big retailers pass higher costs on to consumers, even essentials become more expensive, and that risks slowing the economy.”

Takeaways: Businesses Need to Respond Strategically

U.S. consumers are becoming more practical and price-conscious than ever:

- Only buying what’s truly necessary

- Using second-hand goods more

- Valuing affordability over brand prestige

- Factoring in sustainability

For businesses, it’s essential to read these trends and adjust accordingly:

- Strengthen mid- and low-priced product lines

- Expand refurbished and second-hand offerings

- Highlight sustainability in marketing

- Optimize online sales channels

Tariffs and inflation are external pressures — but responding to consumers is within a company’s control.

Conclusion: The Change Has Already Begun

American consumers are already feeling the weight of tariffs and adjusting accordingly — buying smarter and more selectively.

Tariffs have become part of daily life, and both consumers and businesses are learning new rules of the game.

The key is to understand the flow of change — and move with it.

Consumers are already changing. Now it’s time for businesses to adapt.

Leave a comment