What is Rocket Lab?

Rocket Lab is one of the most important — yet surprisingly underhyped — players in today’s rapidly evolving space economy.

Founded in 2006 by Peter Beck in New Zealand, Rocket Lab set out to democratize access to space, challenging the notion that space is reserved for governments and billion-dollar institutions.

Now headquartered in Long Beach, California, Rocket Lab has become a dual-nation space company with launch and manufacturing facilities in the U.S. and New Zealand. In 2021, it went public on NASDAQ via a SPAC merger under the ticker RKLB.

From launching small payloads to building entire satellite constellations, Rocket Lab is positioning itself not just as a launch provider — but as a full-stack space infrastructure company.

Rocket Lab’s Core Technology: Electron and Neutron

Electron — Small but Mighty

Electron is Rocket Lab’s flagship launch vehicle, designed specifically for small payloads.

Standing about 20 meters tall, it is optimized to deliver payloads of up to 300 kg into low Earth orbit (LEO). It was the first launch vehicle powered by 3D-printed engines (Rutherford) and built using carbon composite structures, enabling cost-effective, rapid deployment.

Why Electron matters:

- ~$7.5M per launch — one of the lowest in the industry

- 72-hour launch readiness

- 40+ successful launches since 2017

- Ideal for CubeSats, research missions, and private commercial payloads

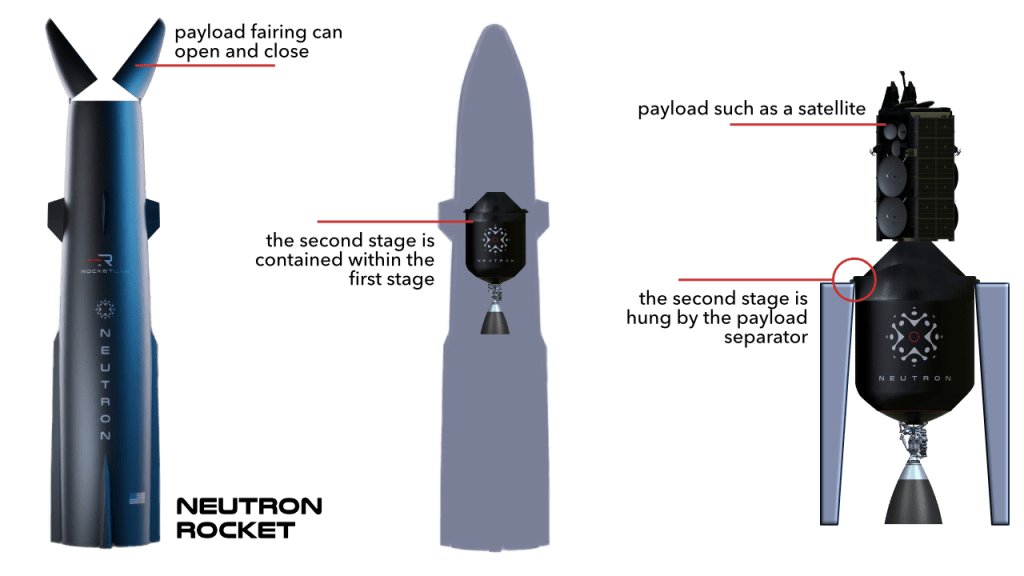

Neutron — Rocket Lab’s Bigger Leap

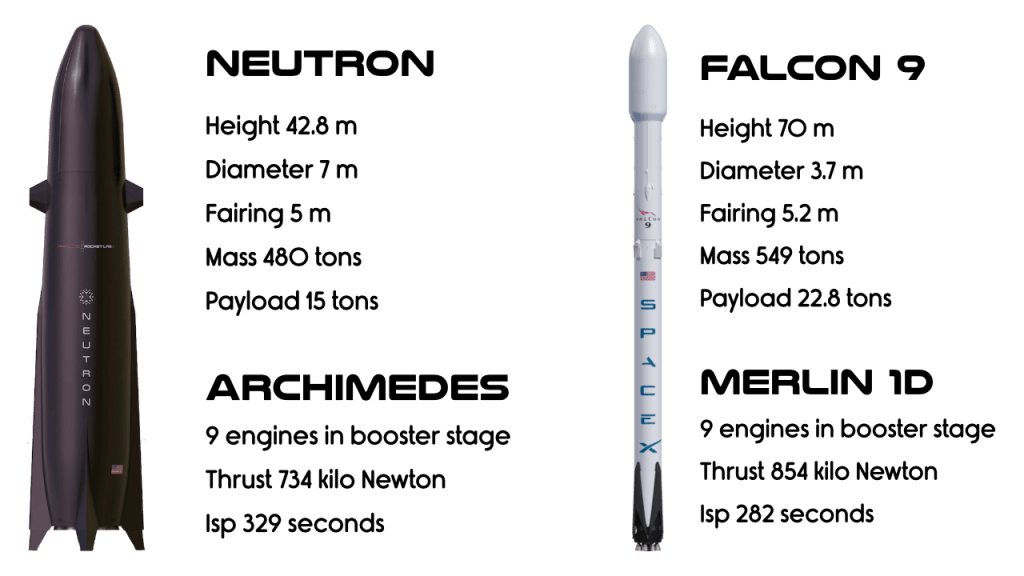

To compete with the likes of SpaceX’s Falcon 9, Rocket Lab is developing Neutron, a medium-lift, fully reusable rocket that will support payloads up to 8,000 kg to LEO.

Neutron’s design integrates a reusable first stage and a focus on constellation deployment, aiming to capture more of the growing demand for mega constellations like Amazon’s Kuiper and other broadband projects.

Neutron’s first launch is anticipated around in the latter half of 2025, which could mark a major milestone in Rocket Lab’s evolution.

How Rocket Lab Stands Apart from the Competition

Rocket Lab is often called the “mini SpaceX”, but it’s more accurate to say they operate in distinct market segments with complementary missions.

| Feature | Rocket Lab (RKLB) | SpaceX |

|---|---|---|

| Focus | Small-lift LEO payloads | Heavy-lift and crewed spaceflight |

| Launch Cost | ~$7.5M | ~$62M |

| Main Rocket | Electron (soon Neutron) | Falcon 9, Falcon Heavy |

| Customers | Startups, research labs, government agencies | NASA, DOD, telecom giants |

| Satellite Platform | Photon | Starlink |

The most strategic differentiator? Photon — Rocket Lab’s in-house satellite platform.

With Photon, Rocket Lab offers end-to-end service: building, launching, and managing satellites.

Position in the Global Space Market

The global space economy is projected to hit $1 trillion by 2030, with the small satellite market growing faster than any other segment.

Rocket Lab’s Electron sits at the center of this opportunity.

- 33% market share in small satellite launches (as of 2021)

- Consistently launching payloads for national security and commercial customers

- Leading non-governmental launch provider outside the U.S.

Electron’s ability to launch rapidly and reliably has made Rocket Lab the go-to provider for clients that can’t afford to wait in line for a SpaceX rideshare.

Key Partnerships and Clients

Rocket Lab serves a wide array of customers across public and private sectors:

- NASA: multiple research satellite launches

- U.S. Department of Defense / DARPA: classified missions, hypersonic tests

- NOAA & weather satellite operators

- Spire, Capella Space, BlackSky: Earth observation

- Private startups & universities around the globe

Notably, Rocket Lab’s strong relationship with the U.S. government sets it apart from many other commercial providers.

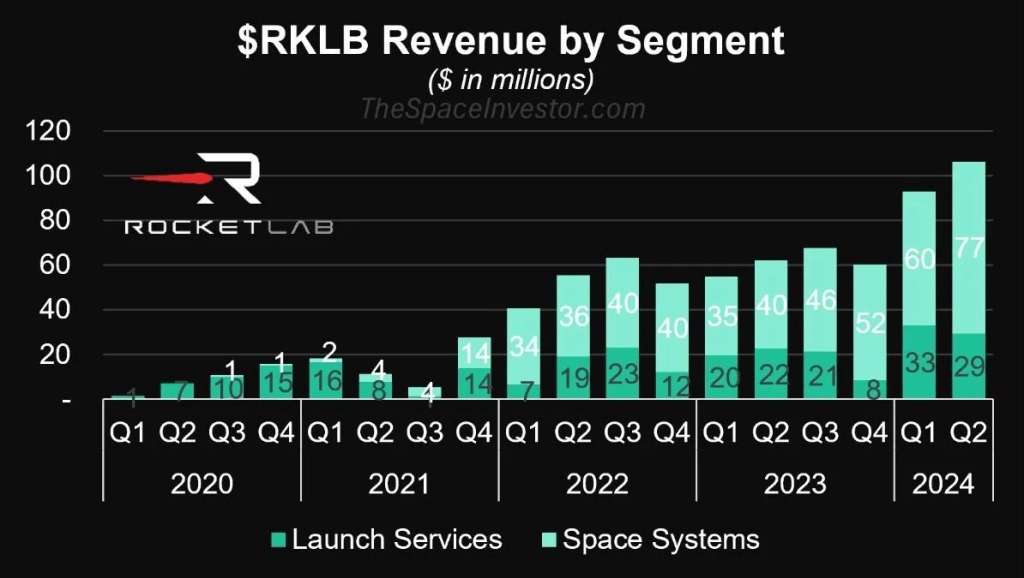

Beyond Launch: Rocket Lab’s Satellite Business

In 2020, Rocket Lab announced a significant pivot: becoming a space systems company, not just a launch company.

They now offer custom-built spacecraft and complete satellite services using their Photon platform.

This includes payload integration, orbital maneuvering, data services, and long-term satellite management.

Why this is a game-changer:

- Integrated supply chain = fewer delays

- Higher margins compared to pure launch services

- Subscription-based revenue model via data and services

Rocket Lab has even floated the concept of “space-based data centers”, hinting at a future where they manage orbital cloud infrastructure.

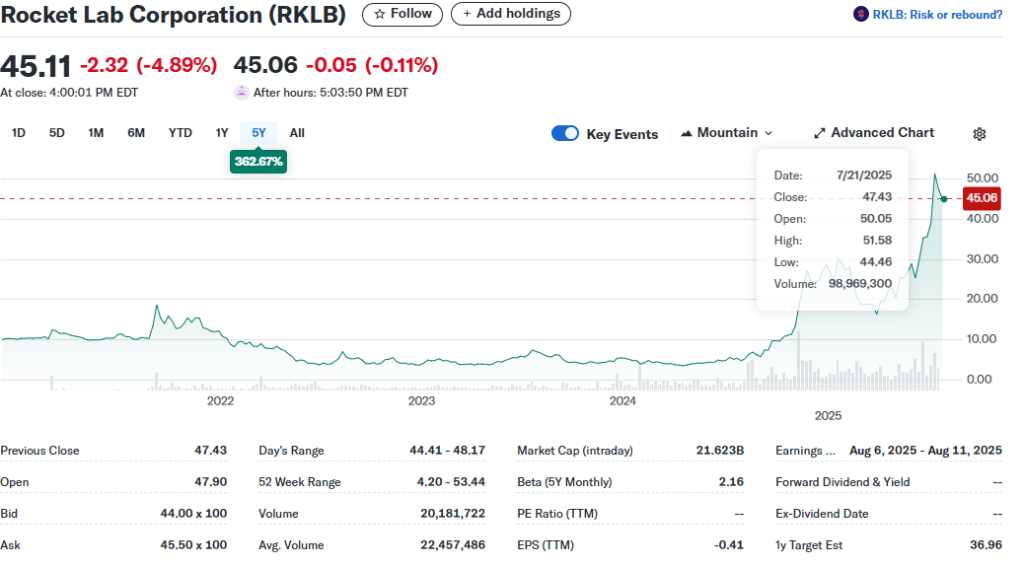

RKLB Stock Performance and Investment Perspective

Price Movement

- IPO (via SPAC) in 2021: ~$10–12

- 2022–2023: Technology correction, bottomed ~$3.5

- 2024: Trading in the $4–6 range

- 2025+: Potential catalyst: Neutron debut, military contracts, satellite revenue growth

Investment Positives

- High entry barriers (tech + capital intensive sector)

- Deep government relationships

- Diversified revenue across launch, satellite, and mission operations

- Clear roadmap to profitability (projected by 2026)

⚠ Risks

- Delay in Neutron development

- Launch failure incidents (historically rare but impactful)

- Volatility in tech and defense sectors

Still, long-term investors betting on space as the next digital frontier may find RKLB undervalued relative to its ambition and technical progress.

Roadmap: What’s Ahead for Rocket Lab?

2024 Goals:

- Complete Neutron prototype and static testing

- Expand Photon sales and partnerships

- More U.S. government launch contracts

- Increase cadence to 15+ Electron launches/year

2025–2026 Outlook:

- First Neutron commercial missions

- Begin orbital satellite fleet management

- Monetize space logistics as a service (SLaaS)

- Reach profitability

Rocket Lab has also hinted at planetary missions, asteroid rendezvous, and deep space commercial services — positioning itself for interplanetary logistics in the next decade.

Could Rocket Lab Be the Amazon of Space?

Rocket Lab’s transition from small launch provider to space infrastructure platform mirrors the story of Amazon — once just an online bookstore, now the backbone of global logistics and cloud computing.

With Electron enabling access, Neutron aiming for scale, and Photon powering long-term operations, RKLB is building the pillars of a multi-orbit space ecosystem.

It may not be as flashy as SpaceX — but in a trillion-dollar space race, Rocket Lab is quietly securing its place as the foundational infrastructure layer of the future orbital economy.

Leave a comment