What Is a “General Trading Company”?

Have you ever heard of a type of company that exists in South Korea but doesn’t really have a direct equivalent in the United States?

We’re talking about the “General Trading Company” (종합상사).

While the U.S., Europe, and Japan all have trading firms and global distributors, South Korea developed a unique corporate model:

a company that handles global trade across multiple industries—from steel and chemicals to cosmetics and food—while also engaging in resource development, overseas investments, logistics, and trade finance.

These companies often don’t manufacture anything themselves.

Yet they run global businesses worth billions of dollars and create value through strategy, networking, and cross-border integration rather than physical production.

In short, they are the hidden architects of Korea’s international business landscape.

So today, let’s explore:

- What is a general trading company?

- How does it operate?

- Why is it unique to Korea?

- What roles does it play in the global economy?

- And how is it evolving in response to new challenges?

If you’re interested in global business, trade, logistics, ESG, or strategic investments, the Korean general trading company is a business model worth understanding.

What Is a General Trading Company?

A general trading company is a firm that handles a wide variety of export and import activities, across many sectors and regions.

But unlike typical trading firms, these companies offer end-to-end solutions:

from sourcing, market research, contract negotiation, customs clearance, logistics, to even project development and resource investment.

For example:

If a small Korean company wants to export semiconductor materials to Europe,

a general trading company will match them with buyers, arrange sample shipments, handle contracts and payments, navigate customs, and ensure local compliance.

They might also engage in high-stakes global business like:

- Developing natural gas fields in the Middle East, or

- Investing in palm oil plantations in Southeast Asia.

Historical Origins: Why Are They Unique to Korea?

South Korea’s general trading companies were born in the 1960s and 70s, during its rapid industrialization period.

To boost exports and earn foreign currency, the Korean government encouraged conglomerates to create dedicated export-oriented entities.

Some of the earliest and most influential include:

- Samsung C&T (1951)

- Hyundai Corporation (1976)

- Daewoo International (1973)

- LG International (1953)

These companies became powerhouses in overseas expansion, establishing offices and networks across the globe.

By the 1980s and 90s, they were not just traders—they were global project developers, handling infrastructure, logistics, and commodity supply chains.

Today’s Leading General Trading Companies in Korea

| Company | Key Sectors | Highlights |

|---|---|---|

| Samsung C&T | Chemicals, Steel, Fashion, Construction | Operates as a hybrid of construction + trading |

| POSCO International | Steel, Energy, Grains | Operates gas fields in Myanmar and grain networks in Ukraine |

| LX International | Resources, Logistics, Power | LG Group spinoff, expanding in green energy |

| Hyundai Corporation | Machinery, Steel, Auto Parts | Strong presence in automotive exports |

| SK Networks | Retail, IT, Rental | Focused on consumer platforms and communication tech |

Other players like GS Global, Hanwha Global, and Hyosung International are also actively strengthening their global trading arms.

What Do They Actually Do?

General trading companies manage the entire business lifecycle of international trade, often functioning as a one-stop solution provider. Their work includes:

Core Business Functions:

- Trade intermediation

Contract negotiations, pricing, and foreign exchange risk management - Market entry and research

Identifying target markets, obtaining local certifications, sourcing buyers - Customs and logistics

Organizing sea/air shipments, warehousing, customs clearance - Trade finance services

Opening L/Cs, export insurance, cross-border payments - Resource and project development

Investing in mines, oil fields, energy plants, and agribusiness projects

How Are They Different from Regular Trading Companies?

General trading companies are larger, more multi-functional, and operate at a global strategic level.

They differ from smaller or more specialized trading firms in the following ways:

| Criteria | Typical Trading Company | General Trading Company |

|---|---|---|

| Size | Small to mid-sized | Large (often part of conglomerates) |

| Product scope | Limited (specific product lines) | Broad, multi-industry portfolio |

| Business scope | Focused on import/export | Includes investment, finance, logistics, and development |

| Market reach | Regional | Global, with local branches and partners |

| Strategy | Short-term sales | Long-term global expansion and development |

Key Trends and Shifts in the 2020s

General trading companies in Korea are undergoing major transformations.

Here are some current trends shaping the sector:

- Sustainability and ESG integration

Expanding into carbon-neutral projects, renewable energy, recycling - Food and resource security

Securing grains, minerals, and energy in unstable global markets - Digital trade platforms

Using AI, blockchain, and data-driven logistics for efficient operations - Entry into emerging markets

Targeting Africa, Latin America, and Southeast Asia for long-term growth

Why General Trading Companies Still Matter

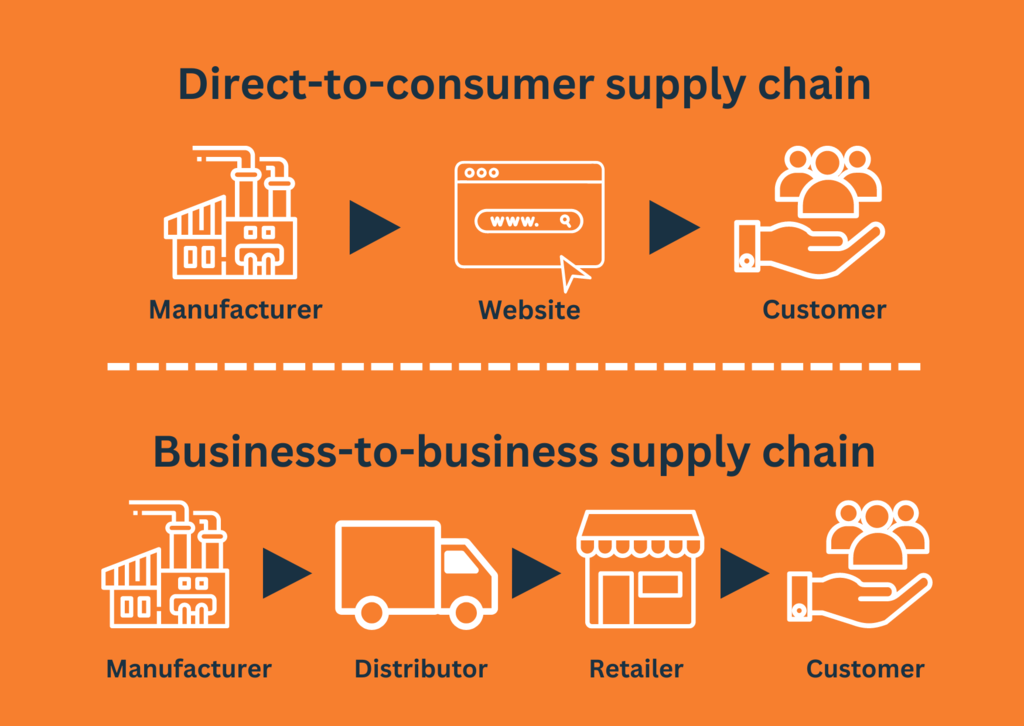

In an era where platform-based commerce (like Amazon, Alibaba) and direct-to-consumer exports (D2C) are rising,

some might assume that traditional intermediaries are becoming obsolete.

But that’s far from the truth.

Global trade has never been more complex, and challenges like:

- Geopolitical risk

- Supply chain disruption

- Commodity volatility

- Regulatory differences

require specialized expertise and global infrastructure—exactly what general trading companies offer.

They’re not just sales agents; they’re risk managers, investment strategists, and international operators.

The Future: Will They Fade or Flourish?

It’s true that the traditional role of a “middleman” is shrinking in some sectors.

However, the strategic function of general trading companies is becoming even more valuable in others.

We’re seeing a shift from simple trading to becoming:

- Global investment arms

- Project developers

- ESG solution providers

- Supply chain stabilizers

In this sense, the title “trading company” may no longer fully reflect what they do.

They are closer to global business architects than mere brokers.

Final Thoughts

You may not see them in advertisements or retail stores,

but Korean general trading companies are the quiet giants that keep the country connected to the world.

They are deeply embedded in the infrastructure of global business,

linking supply with demand, bridging national economies, and driving strategic growth.

If you’re interested in a career in global markets, supply chains, sustainability, or international investment,

these companies are worth exploring—not only for what they do,

but for how they adapt, evolve, and lead in an unpredictable world.

Leave a comment