In today’s fast-changing retail landscape, few phenomena have disrupted the market as dramatically as Digital Native Brands — companies that were born and built entirely in the online ecosystem before expanding into the physical world. These brands didn’t inherit brick-and-mortar stores from the start. Instead, they grew from websites, social media accounts, and direct conversations with consumers, mastering the art of D2C (Direct-to-Consumer) engagement long before traditional retailers caught on.

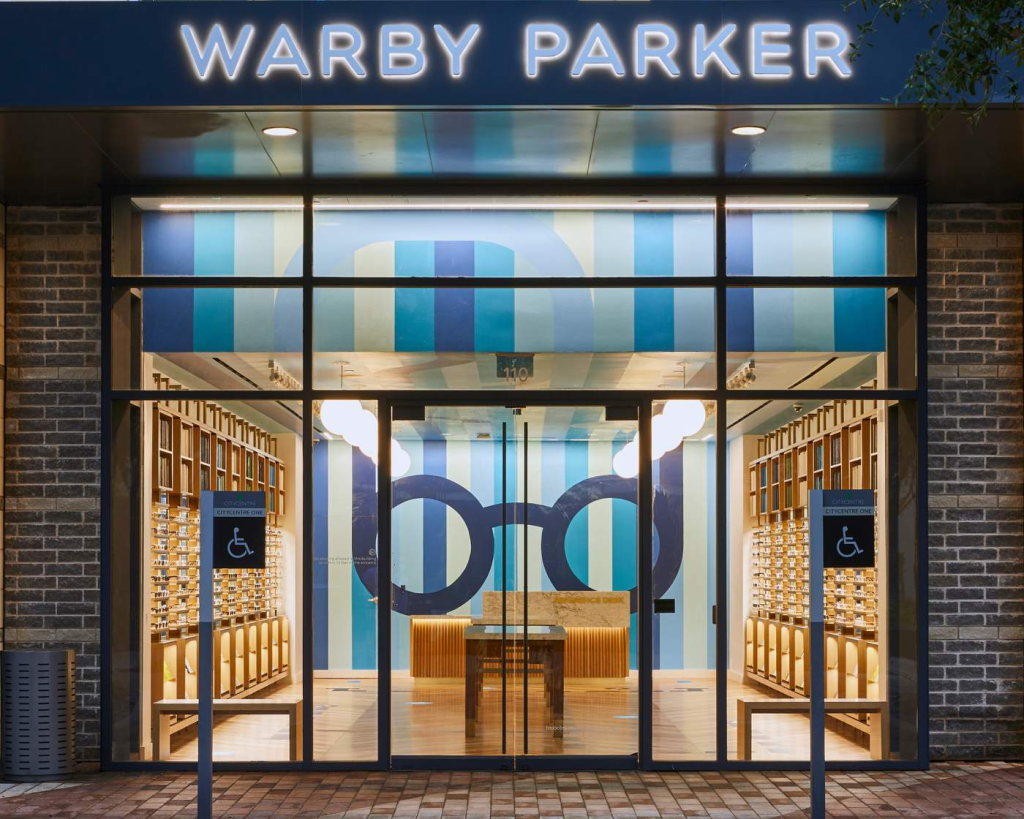

Names like Warby Parker (eyewear), Casper (mattresses), and Glossier (beauty) have become textbook examples. Their origin stories differ, but their core strategy is the same: start with a strong online identity, cultivate an engaged audience, collect and act on consumer feedback, then bring that energy into carefully curated offline experiences such as pop-up shops and flagship stores.

From Audience to Community — and Then to Fandom

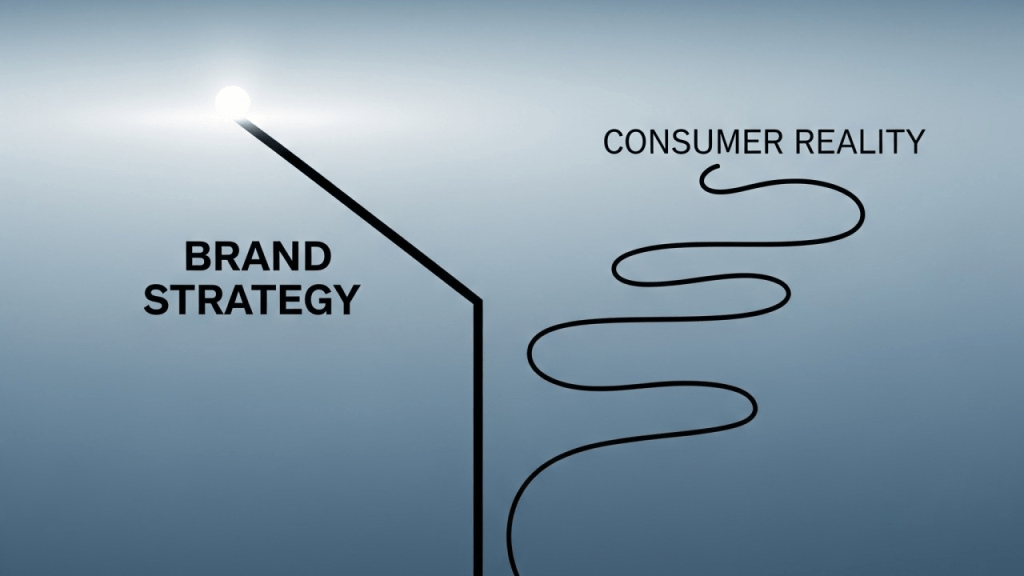

The greatest weapon in a Digital Native Brand’s arsenal is its proximity to the customer. Traditional corporate marketing often broadcasts messages from a distance — glossy ads, scripted campaigns, celebrity endorsements. In contrast, digital-first brands operate more like community members than corporate entities. They ask questions, respond to comments, and incorporate consumer ideas directly into their product roadmaps.

Take Glossier for example. The company began as Into the Gloss, a beauty blog that gathered real-life stories, tips, and reviews from everyday users. When it transitioned into a product-based business, that community stayed intact — and grew. Glossier actively monitored thousands of social media reviews and comments to adjust formulas, textures, scents, and even packaging. This consumer-driven iteration turned early buyers into passionate brand advocates.

Importantly, Digital Native Brands don’t just sell products; they sell a shared value system. Whether it’s minimal packaging, cruelty-free formulas, or sustainable sourcing, these values become part of the customer’s own identity. In turn, customers promote the brand on their own — through hashtags, unboxing videos, and personal recommendations — creating a viral network effect without massive advertising budgets.

Data as a Design Tool

For a Digital Native Brand, data isn’t just a marketing metric — it’s the backbone of both design and inventory strategy.

Every website visit, cart abandonment, product review, or social media interaction becomes a data point. This granular insight allows brands to personalize recommendations, identify high-propensity buyers, and predict trends faster than traditional competitors.

Consider Allbirds, the eco-conscious footwear brand. Not only does it use consumer data to decide which colors and styles to release, but it also tailors communications to specific audience segments. A loyal customer might get early access to a limited-edition color, creating a sense of exclusivity and belonging. This is more than email marketing — it’s behavioral design that strengthens brand loyalty.

The Shift to Physical: Pop-Up and Flagship Strategy

One might assume that Digital Native Brands would remain purely online. But many have recognized the power of physical touchpoints — not as mass distribution channels, but as high-impact brand experience hubs.

Warby Parker is a prime example. After proving the viability of buying glasses online (with home try-on kits), the company launched flagship stores in major U.S. cities. These locations serve as both showrooms and community spaces, allowing customers to try frames in person, receive optical services, and engage with the brand’s story.

Similarly, Glossier has flagship stores in Los Angeles and New York, designed not just for shopping but for immersion. Visitors experience the brand’s values — transparency, inclusivity, and playful beauty culture — in a tactile, Instagrammable environment.

Agile Supply Chains for the Digital Age

Another competitive edge lies in supply chain strategy. Digital Native Brands rarely follow the mass-production, high-inventory model of legacy brands. Instead, they adopt flexible, small-batch manufacturing and real-time adjustments based on demand data.

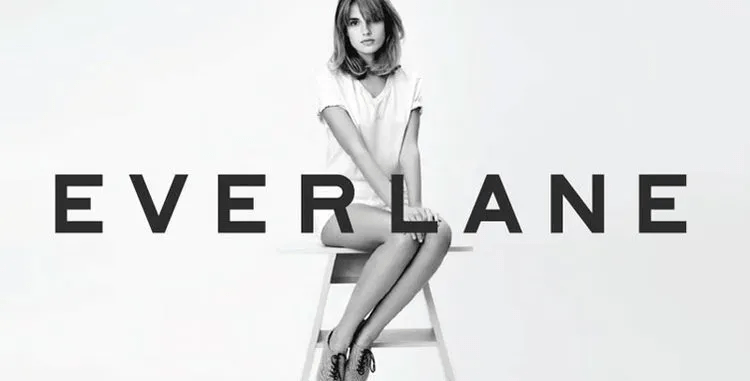

For example, Everlane uses regional demand analytics to produce only what is needed for specific markets. Outdoor Voices, an activewear label, works with both domestic and international manufacturing partners to balance lead time, cost, and quality. Localized production shortens delivery windows and reduces shipping costs, while overseas partnerships keep prices competitive.

Some brands even use pre-order models to test demand before manufacturing — virtually eliminating excess inventory and the need for heavy discounting.

Redefining the Brand-Consumer Relationship

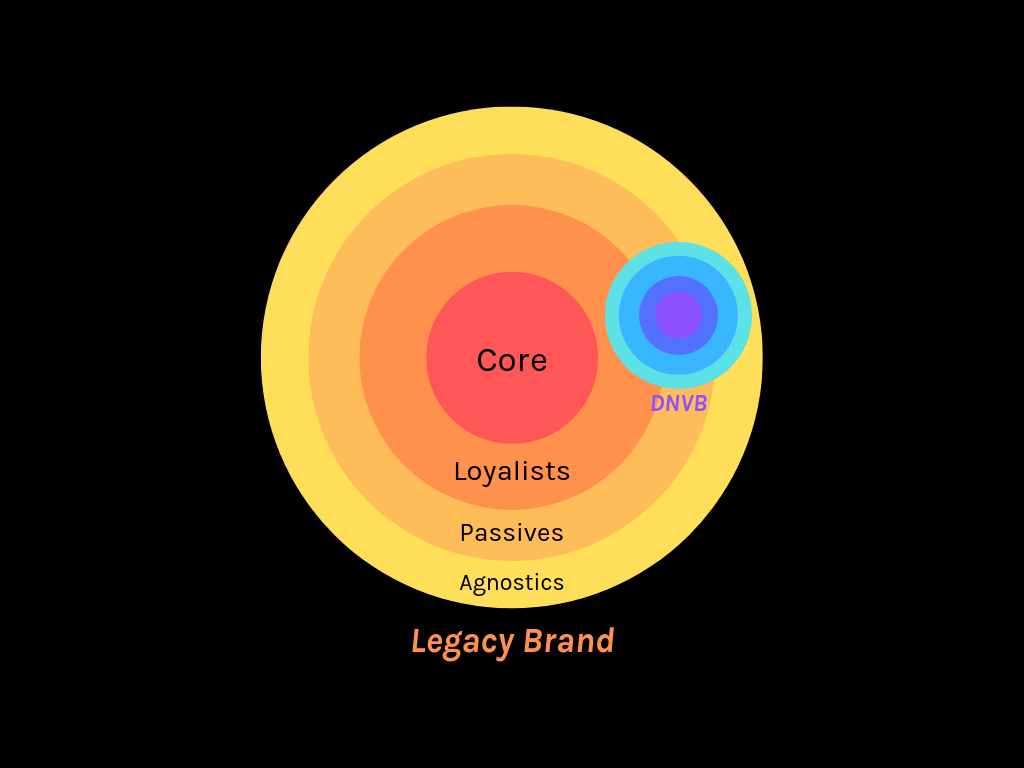

The rise of Digital Native Brands signals more than just a shift in distribution channels. It’s a paradigm change in how brands and consumers relate.

In the DNB model:

- The brand is not a distant vendor but a peer in the community.

- Customers are not passive buyers but co-creators.

- Product launches feel like community milestones rather than corporate decisions.

This approach resonates particularly strongly with Millennial and Gen Z consumers, who tend to value transparency, ethical sourcing, and brand authenticity as much as — or more than — the product itself.

The Technology-Driven Future

Looking ahead, Digital Native Brands are poised to integrate next-generation technologies to deepen customer engagement:

- AR-powered virtual fitting rooms to reduce uncertainty in online shopping.

- Live commerce experiences that merge entertainment and sales in real time.

- AI-driven personalization engines that adapt product suggestions based on subtle behavioral cues.

Traditional retail giants are already responding — ramping up their online channels, experimenting with direct consumer engagement, and rethinking their own supply chains.

Key Takeaways

The success of Digital Native Brands in the U.S. comes down to:

- Community-first branding — turning buyers into fans.

- Data-driven product evolution — using analytics not just for sales, but for design.

- Hybrid retail presence — balancing the efficiency of online with the intimacy of physical.

- Agile supply chain management — reducing waste while staying trend-responsive.

- Technological integration — staying ahead of consumer expectations.

For Korean startups and SMEs, the lesson is clear:

You don’t need a massive advertising budget to compete with global players. You need a clear value system, direct engagement, and the agility to respond to your community in real time. From beauty to fashion to wellness, the digital-native approach can break down market barriers — and build loyalty that lasts.

Leave a comment