The U.S. economy right now looks like a strange split-screen:

On the left, Americans are partying in full costume, drowning in pumpkin lights and cinnamon-toast KitKats.

On the right, consumers brace for higher prices, thinning savings, and shrinking discounts heading into the biggest shopping week of the year.

This contrast — Halloween boom vs. Black Friday uncertainty — tells us something important about the real state of the U.S. consumer.

Let’s break it down.

Halloween Spending Surged to $13.1 Billion — A Record, Despite Shutdowns & Tariffs

Every October, American neighborhoods transform into Halloween towns.

Kids prepare costumes weeks in advance, homes fill with skeletons and fake cobwebs, and grocery stores dedicate entire aisles to chocolate.

This year?

Halloween spending hit $13.1 billion — the highest ever.

Breakdown (NRF data):

- Candy: $3.9B (29%)

- Costumes: $4.3B (33%)

- Decorations: $4.2B (32%)

- Greeting cards: $0.7B (5%)

What makes this remarkable is that the U.S. was dealing with:

- a prolonged federal government shutdown,

- Trump-era tariffs pushing up costs,

- inflation in essentials.

By all logic, consumers should have pulled back.

Instead, they spent more than ever.

Why Did Halloween Get So Expensive?

Because Halloween candy — especially chocolate — is on the front lines of America’s tariff war, global climate shocks, and inflation spiral.

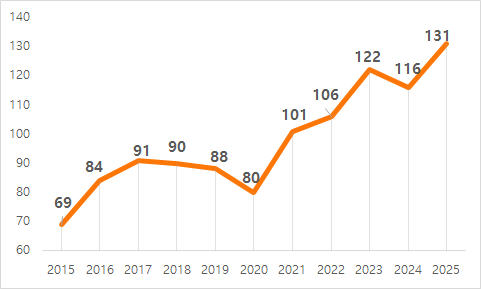

1) Chocolate prices exploded: +30% since last Halloween, +78% over five years

Key drivers:

- West African crop failures (Ivory Coast, Ghana produce 60% of the world’s cocoa)

→ Cocoa futures jumped 178% - U.S. tariffs on cocoa imports processed in Europe

- Aluminum tariffs hitting foil packaging

- Energy + labor costs rising at the same time

Hershey expects $100 million in extra tariff-related costs this year.

Small makers like Taza Chocolate paid $24,000 in new tariffs on a single cocoa shipment — enough to consider relocating to Canada.

2) The result? Shrinkflation + flavor gimmicks

- Hershey committed to “keep package price, reduce contents.”

- Analysts expect shrinkflation to worsen.

- Companies started lowering cocoa levels →

Cinnamon Toast KitKats, Pumpkin Spice Chocolate, Strawberry Ice Cream Hershey Kisses.

These aren’t flavor innovations.

They’re cost-saving strategies disguised as novelty.

Yet Consumers Still Spent More: Because Halloween Is Now an “Experience”

NRF found that 73% of Americans planned to celebrate Halloween regardless of cost.

Average per-person spending hit $114, a historic high.

This isn’t about candy.

It’s about experience consumption — the dominant millennial/Gen Z spending pattern.

PwC says consumers are investing in:

- photogenic costumes for Instagram

- themed parties with “emotional resonance”

- social-media-worthy moments

Halloween has become less a holiday and more an event economy, where people pay for memories, not items.

MZ / Gen Z start shopping in July — Summerween

PwC found:

- 11% of MZ/Gen Z engage with “Summerween” promotions starting midsummer

- Boomers? Only 1%

Nearly half (49%) start shopping by September or earlier.

Reasons:

- looking forward to fall (44%)

- Halloween is their favorite holiday (37%)

- fear of items selling out (33%)

- avoiding last-minute stress (33%)

Halloween is now the earliest and longest shopping season after Christmas.

But Black Friday? The Signals Are Not So Rosy

Halloween spending tells us Americans want to celebrate.

But Black Friday — the real indicator of consumer health — faces serious headwinds.

NRF predicts holiday sales will grow 2.7–3.7%, citing low unemployment and rising wages.

But PwC and retail analysts see a different reality.

1) Tariffs have already baked into inventory — discounts will shrink

Retailers paid higher tariffs months ago.

Their inventory is already “inflated,” so deep Black Friday discounts are unlikely.

Higher costs → smaller markdowns → weaker turnout.

A simple chain reaction.

2) Young consumers are cutting back

June surveys show:

- 23% of Gen Z plan to significantly reduce spending over the next six months.

- MZ/Gen Z cite rising living costs, rent, food, and student debt.

In other words:

Halloween is fun; Black Friday requires real money.

3) Expert view (Aprio legal consultant)

- “Companies already absorbed high tariffs preparing inventory.”

- “This will reduce discount depth during Black Friday.”

- “But it won’t fundamentally break MZ/Gen Z spending culture.”

Translation:

There will be a slowdown — just not a collapse.

Final Take — Halloween Was a Party, Black Friday Will Be a Test

🔹 Halloween spending hit record highs

→ Because it’s emotionally driven, not economically driven.

🔹 Prices surged because of tariffs, climate shocks, and inflation

→ The candy aisle is a microcosm of global economic stress.

🔹 But Black Friday is where real consumer weakness shows

→ Discounts will shrink, and younger shoppers are tightening budgets.

🔹 U.S. consumer sentiment is split between “want to spend” and “can’t spend”

→ Halloween surged because it’s cheap to celebrate small moments.

→ Black Friday may falter because it requires real disposable income.

America is in an odd moment where the party is louder than the paycheck.

If Halloween was the spark, Black Friday will be the stress test.

Leave a comment