Charts don’t lie, but sometimes they only tell half the truth. Investor sentiment toward Bitcoin has turned ice cold. The data is brutally clear: Bitcoin in December 2025 is tracing a pattern 98% identical to the nightmare crash of 2022.

Retail investors are fleeing in fear. But if you miss the $22 billion contradiction hidden behind this “fear data,” you are missing the most critical signal of this cycle.

98% Synchronization: Price Doesn’t Lie

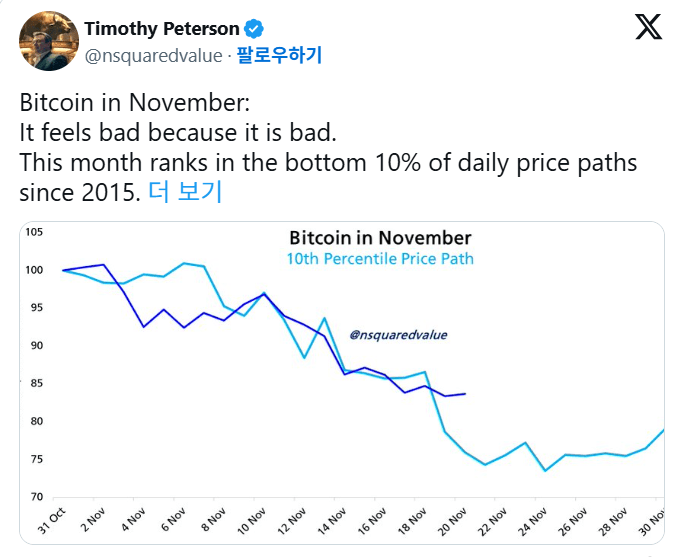

Economist Timothy Peterson’s analysis is chilling. Bitcoin’s current price action is a twin to the second half of 2022, a period marred by the Luna collapse and FTX scandal (Daily correlation 80%, Monthly correlation 98%).

- Retail Sentiment: Crashing through the floor.

- Price Action: A tedious downward drift with no bounce.

Applying past patterns, a meaningful recovery is likely delayed until Q1 2026. This is the “surface-level bad news” everyone sees.

The $22 Billion Mystery: Money is Looking Elsewhere

:max_bytes(150000):strip_icc()/GettyImages-2247341381-c6855ae613334816acda5c973b08df35.jpg)

This is where real research comes in. If the price is collapsing like in 2022, money should be fleeing. But we are seeing the exact opposite (Divergence).

- The Kobeissi Letter Data: In just the Thanksgiving week, Bitcoin Spot ETFs saw $22 billion in inflows.

- US Stock Market: With $450 billion inflows over the last 5 months, risk-on sentiment remains alive.

Why are institutions buying at record levels while the price drops? This is a classic institutional “OTC Absorption” pattern. Institutions don’t buy by sweeping the order book and driving up prices. They quietly absorb the panic-selling volume from retail investors or accumulate via Over-The-Counter (OTC) markets.

In short, this drop isn’t a fundamental collapse. It is a “Great Handover” where assets are moving from impatient retail hands to institutional vaults.

Why ‘Q1 2026’? (The Tax-Loss Harvesting Effect)

There is a structural reason why experts pinpoint the rebound for Q1 next year: “Tax-Loss Harvesting.”

- Year-End Strategy: US institutions and whales sell losing assets at year-end to realize losses and offset taxes. Coins that underperformed throughout 2025 are being dumped in December.

- January Effect: This selling pressure vanishes after December 31st. As the new year (Q1 2026) begins, the rebalancing of funds back into the market starts.

Therefore, the current decline is less about fundamentals and more about artificial suppression caused by tax strategies meeting institutional accumulation.

Buy the Fear, or Sell into It?

The charts of 2022 and 2025 look alike, but the Players are entirely different. 2022 was a market where everyone died due to leverage bubbles bursting. Late 2025 is a market where institutions are opening their massive ETF pockets, waiting for retail Capitulation.

You don’t need to be scared just because Bitcoin moves like it did in 2022. Institutions have bet $22 billion here—do you have a reason not to? The real game begins in Q1 2026, after the retail investors have been shaken out.

[Poll: What is your position?] At this very moment, what is your move?

- 🥶 Sell in Fear: It’s 2022 all over again. Get out now.

- 💎 HODL: Close my eyes and hold until Q1 next year.

- 🐳 Buy like a Whale: Fear is opportunity. Accumulate more!

Trader DK’s Note

- The Correlation: Price is 2022 (Bearish), but Flow is 2021 (Bullish).

- Key Insight: The divergence between price drops and ETF inflows is a strong buy signal. Don’t watch the price; watch the Flow.

- Strategy: The current dumping due to tax-loss harvesting might paradoxically be the last chance to position yourself alongside smart money.

Leave a comment