Wall Street is currently licking its lips, anticipating the sweet candy known as the “Santa Rally.” But the expression on the face of our Santa Claus—Jerome Powell—looks anything but festive.

This week (Dec 8–12) is the “Super Week” that will determine the final grade for the 2025 market. We have a collision of the Federal Reserve’s interest rate decision (FOMC) and the earnings report of Broadcom, which reveals the true stamina of the AI industry.

The market is ready to pop the champagne, but real traders are checking the emergency exits. Why?

The 25bp Cut is No Longer “News” (It’s Priced In)

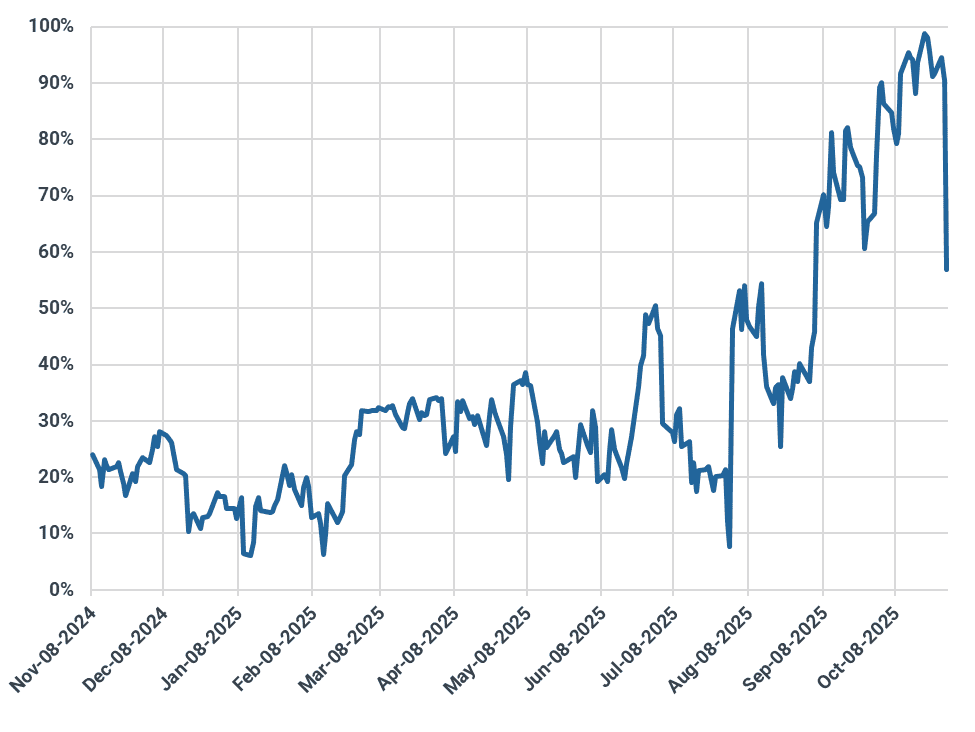

According to the CME FedWatch Tool, the market has already priced in an 87.2% probability of a 25bp rate cut this December. Remember the golden rule of the stock market: “News that everyone knows is not news.”

A rate cut that is already reflected in the price has no power to lift the market further. The real game begins after the decision—specifically, during Powell’s press conference and in the Dot Plot.

- The Internal Split: For the first time in a while, there is a fierce standoff between the Doves (easing) and the Hawks (tightening) inside the Fed. If we see a surge of “dissenting votes” or if the Dot Plot reduces the number of projected cuts for 2026, the market will panic.

- No Santa? If Powell remains vague or hawkish about the rate path for 2026, the expected Santa Rally will be replaced by a “Volatility Shock”.

The AI Bubble’s “Thermometer”: Watch Broadcom

If the Macro has Powell, the Micro has Broadcom. Broadcom’s earnings, set to be released on the 11th, are not just a report card for a semiconductor company. Broadcom acts as the “Thermometer of the AI Industry,” connecting Nvidia to the Big Tech giants.

- Why Broadcom? Broadcom supplies custom chips (ASICs) and networking gear to tech giants like Google and Meta. If Broadcom’s guidance dips, it is the surest leading indicator that “Big Tech is cutting AI spending”.

- Oracle’s Backlog: A day earlier (the 10th), Oracle reports earnings. We need to verify if the massive $455 billion Remaining Performance Obligation (RPO) they boasted about in September is actually converting into revenue. We will find out if this is “AI Hype” or “AI Profit.”

The Last Line of Defense: Costco

Even if AI flies high, it means nothing if the ground-level economy collapses. Costco’s earnings (Dec 11) are the barometer for the spending power of the American middle class. With warnings that the labor market is cooling (JOLTS, etc.), a slowdown in Costco’s revenue would reignite the fear of a “Recession.”

What Is The Main Strategy

This week, even the classic strategy of “Buy the Rumor, Sell the News” is risky. The interpretation of the news is likely to be highly divided.

- FOMC Day (Dec 10): Pay less attention to Powell’s script and more to the “Dot Plot Shifts” and the “Level of Dissension” among Fed members. If it’s not unanimous, the market will get nervous.

- Tech Sector: If you hold Nvidia, you must check Broadcom’s “Guidance.” Even if their current earnings are good, conservative guidance could trigger a sell-off in the entire sector.

Whether Santa brings us gifts or layoff notices will be decided this week.

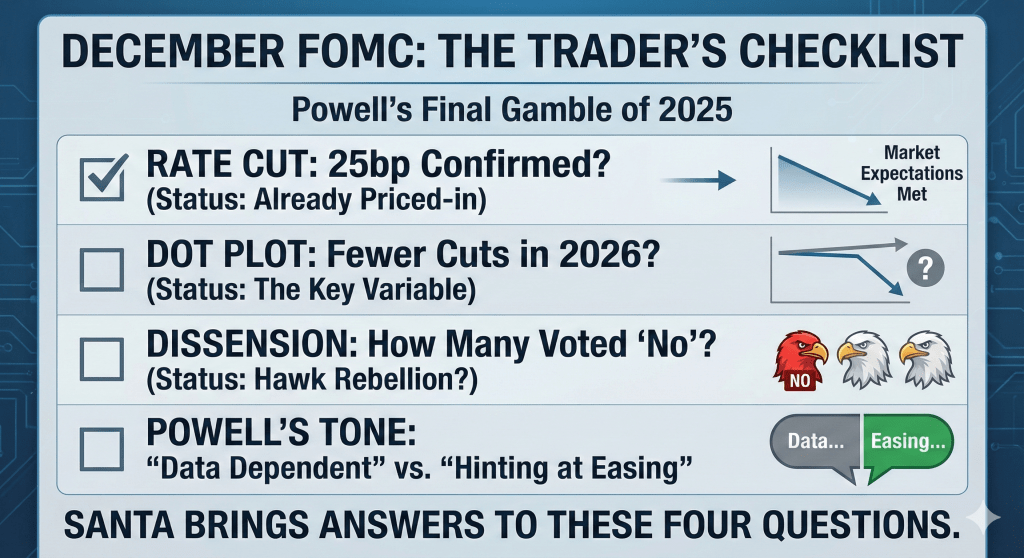

Checklist for December FOMC

Do not just listen to the speech; watch these four signals.

(Image Placeholder: Trader DK’s FOMC Checklist)

- ☑ Rate Cut: 25bp confirmed? (Already Priced-in)

- ☑ Dot Plot: Fewer cuts in 2026? (The Key Variable)

- ☑ Dissension: How many voted ‘No’? (Hawks Rebellion)

- ☑ Powell’s Tone: “Data Dependent” vs. “Hinting at Easing”

Leave a comment